Bob Herman and Casey Ross report for StatNews on Medicare Advantage plans’ use of Artificial Intelligence (AI) to deny life-saving and quality-improving services to their enrollees needing costly care. Without appropriately taking account of patients’ individual health status, Medicare Advantage plans restrict needed nursing home care and physical therapy, as well as delay critical cancer care and more. The more they do, the more they profit.

In one case, Security Health, a Medicare Advantage plan refused to cover more than 17 days of nursing home care for an 85 year-old woman with a fractured shoulder and uncontrolled severe pain. The Medicare Advantage plan said she could go home, even though it was clearly unsafe for her to do so. She could not perform any activities of daily living without assistance, and she lived alone.

More than a year later, a federal judge found that Security Health was liable for the additional three weeks of nursing home care the woman had to pay for out of pocket. She had precious little means to do so and was forced to spend her limited savings down to the point where she qualified for Medicaid. Given how relatively few people appeal Medicare Advantage denials, Security Health and other Medicare Advantage plans make out like bandits restricting care.

STAT’s investigation found that these inappropriate denials are growing as a result of AI. That should be expected. Medicare Advantage plans face no penalty for these types of egregiously inappropriate denials. Instead, enrollees face serious penalties, forced to pay for life-sustaining care out of pocket or to go without.

The federal government is not overseeing the algorithms the AI uses to deny and delay care inappropriately, particularly for people who are very sick. The patients can appeal the denials, but that can take years. Often, by that time, the patients have died or suffered gravely.

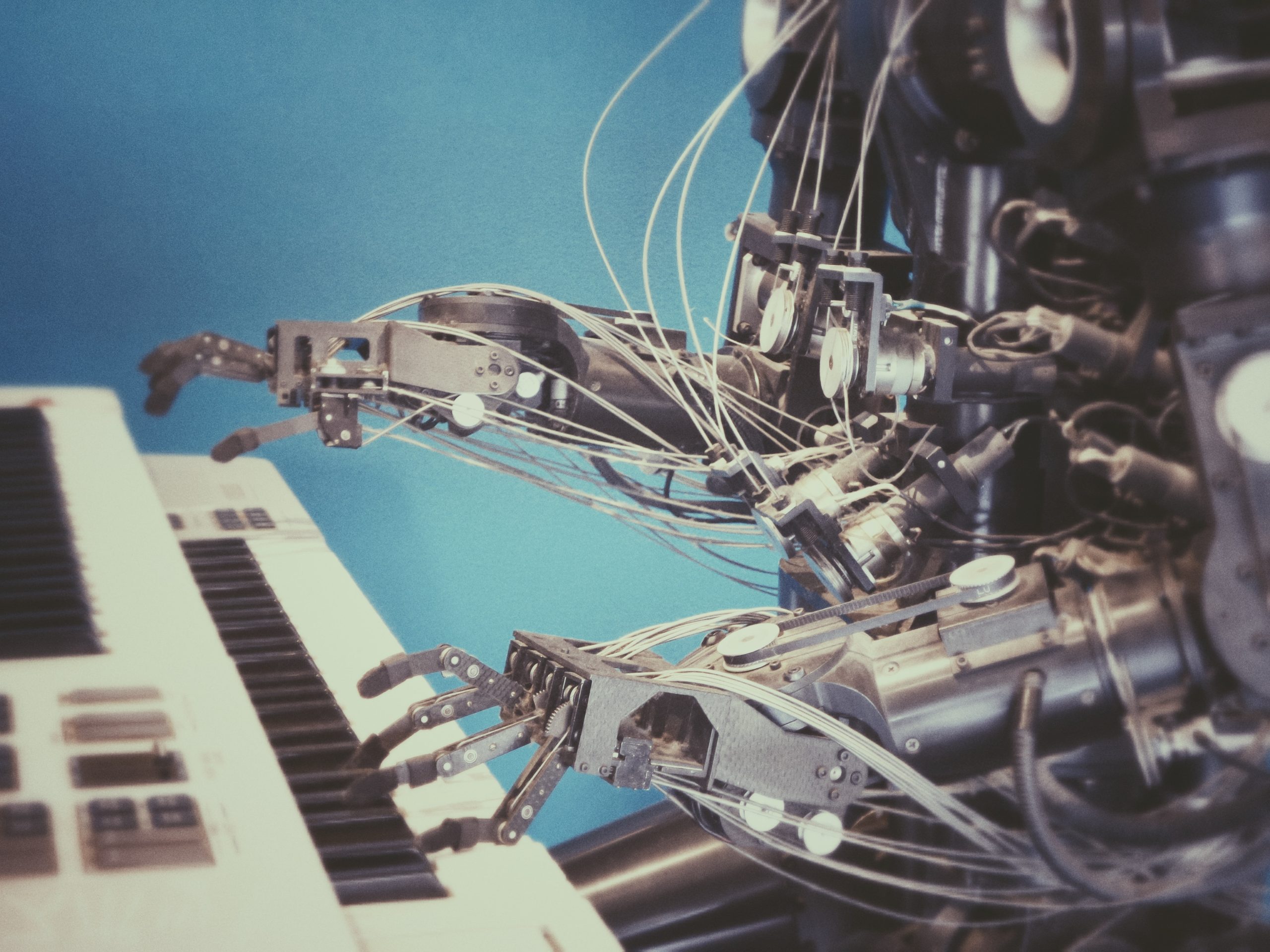

You can only imagine who is programming the algorithms and what these programmers are directed to do when they do the programming. The MA plans want as many denials and delays as possible to maximize their profits. They seem to treat enrollees like widgets, rather than as individuals with unique needs.

We do not know how many MA plans use AI to make medical necessity determinations, but we do know that most of the largest ones do, including UnitedHealth Group, Elevance, Cigna, and Aetna/CVS Health. The biggest company offering AI services to MA plans is NaviHealth, which UnitedHealth now owns.

NaviHealth, for its part, claims its AI algorithms do not make coverage determinations, but simply are used to let physicians and other health care providers know about their patients’ care needs. And, yes, the sky is green.

The Stat reporters point out that the FDA must approve AI products that are designed to detect cancer or recommend treatments. But, the Medicare Advantage plans can use whatever AI tools they please to decide whether care is warranted and to pay for a procedure. Not surprisingly, MA plans deny care that is covered in traditional Medicare–which they are required to cover–often without speaking with the patient’s treating physicians.

In one instance, a Medicare Advantage plan denied a stroke patient rehabilitation care. Yet, the patient couldn’t feed himself. He had signed up for a Medicare Advantage plan, wrongly assuming it would cover the care he needed.

Several years ago, when the government decided to pay a fixed upfront fee for post-acute services, such as nursing home care, it gave the providers an incentive not to overtreat, saving the government money. But, it also gave these providers an incentive to undertreat. The less care they offered, the more of the upfront money they could keep for themselves.

NaviHealth works with many Medicare Advantage plans. It promises to “manage” enrollees’ care post hospital discharge. If it saves the Medicare Advantage plans money, it shares in the savings. Talk about an incentive for NaviHealth to focus on cost-savings and not quality improvement or good health outcomes.

Christina Zitting, a hospital case management director in Texas, reports that “NaviHealth will not approve [skilled nursing] if you ambulate at least 50 feet. Nevermind that you may live alon(e) or have poor balance,” “MA plans are a disgrace to the Medicare program, and I encourage anyone signing up..to avoid these plans because they do NOT have the patients best interest in mind. They are here to make a profit. Period.”

The Medicare Advantage plan nursing home denials appear to be largely inappropriate, with most denials that are appealed, overturned. Even when Medicare Advantage plans approve nursing home stays, Medicare Advantage plans usually only cover care for 14 days, even though Medicare covers up to 100 days.

The Centers for Medicare and Medicaid Services, which oversees Medicare, proposed new rules which would prevent Medicare Advantage plans from denying coverage “based on internal, proprietary, or external clinical criteria not found in traditional Medicare coverage policies.” If those rules are finalized, it’s not clear that the Medicare Advantage plans could use NaviHealth or any other AI tool to deny care.

But, again, the Medicare Advantage plans claim they are not using NaviHealth to deny care, only to guide coverage decisions. And, the CMS rule if finalized would still permit the Medicare Advantage plans to have internal coverage criteria if based on generally accepted treatment guidelines that are public. The insurers’ opposition to the proposed rule made the case that the government needed to give them “flexibility to manage post-acute care.”

One relative of a Medicare Advantage enrollee who was denied needed nursing home care reports: “I’ve still got friends who say, ‘Oh, I’ve got UnitedHealthcare Advantage, and it’s wonderful.’” “Well, it is,” she said. “Until you need the big stuff.’”

Here’s more from Just Care:

- The choice between traditional Medicare and Medicare Advantage: It’s a sham

- The wrong choice of Medicare Advantage plan could kill you

- Four things to think about when choosing between traditional Medicare and Medicare Advantage plans

- People with serious health needs more likely to disenroll from Medicare Advantage plans

- Medicare Advantage enrollees face higher likelihood of hospital care denials

Leave a Reply