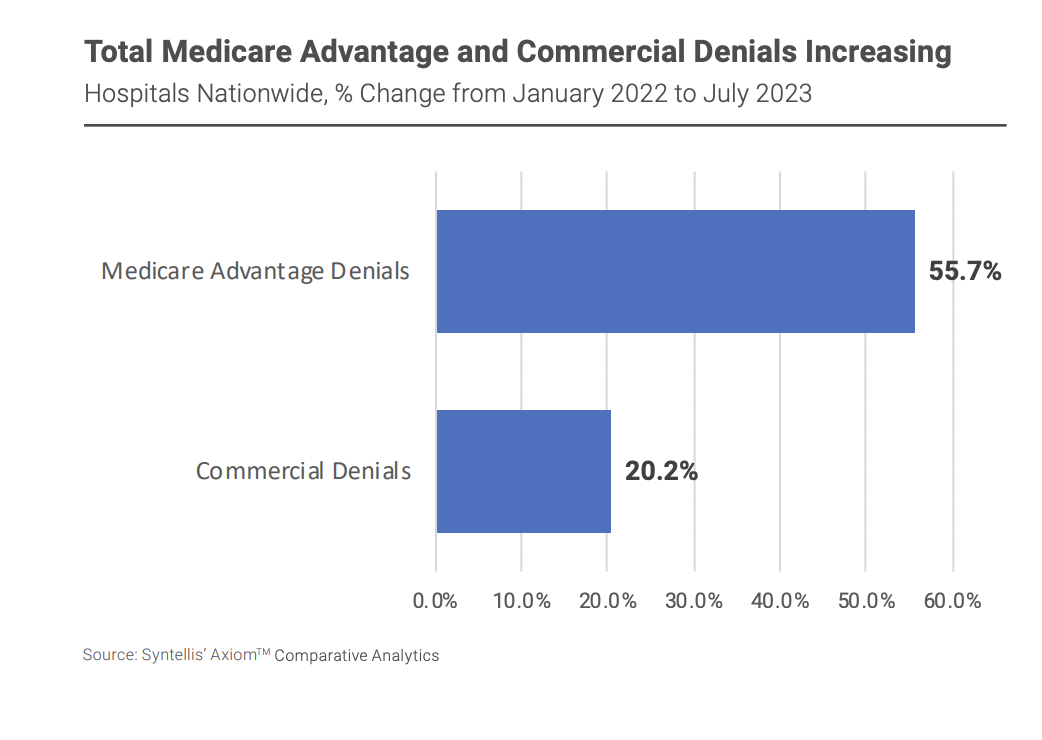

The American Hospital Association just released findings that Medicare Advantage denials are up 56 percent. It seems the corporate health insurers offering people Medicare benefits through Medicare Advantage have determined that they can deny coverage and payment with impunity. In the process, they can boost their profits.

How many people in Medicare Advantage plans are at risk of dying needlessly because of all these Medicare Advantage denials? According to one study a few years back, the number was “tens of thousands.” Today, with more than 30 million people enrolled in a Medicare Advantage plan and denial rates up considerably, I wouldn’t be surprised if it’s hundreds of thousands of lives lost needlessly by people denied critical care in Medicare Advantage plans.

The American Hospital Association report focuses on revenue the insurers refused to pay hospitals and health systems for patients enrolled in Medicare Advantage. These denied payments lead hospitals and health systems to withhold care they would otherwise provide for fear of not being paid. Hospitals and health systems also say that they are unduly burdened by prior authorization requirements the insurers offering Medicare Advantage plans impose.

“It’s become a game of delay, deny and not pay,” according to Chris Van Gorder, president and CEO of San Diego-based Scripps Health. That perfectly sums it up.

Hospitals and health systems are dropping their Medicare Advantage contracts in droves in order to stay afloat financially. They also say that they are often unable to provide Medicare Advantage enrollees with the care they need, putting their health at risk. The Biden Administration needs to step in now to save lives and protect older Americans and Americans with disabilities.

The Administration needs to stop enrollment in any and all Medicare Advantage plans where there is evidence of wrongful denial rates above 10 percent and/or high mortality rates; it should also give people in these Medicare Advantage plans a way to enroll in traditional Medicare through a government imposed out-of-pocket cap, as in Medicare Advantage. Given the tens of billions of dollars in overpayments to Medicare Advantage plans each year, more people in Traditional Medicare would be a money-saver, even with an out-of-pocket cap.

Here’s more from Just Care:

- OIG finds widespread inappropriate care denials in Medicare Advantage

- Underpayments lead hospitals and specialists to cancel Medicare Advantage contracts

- If you’re in a Medicare Advantage plan, watch out! Your doctor or hospital might no longer be in-network

- 2023: Four things to know if your income is low and you have Medicare

- 2023: Five things to think about when choosing between traditional Medicare and a Medicare Advantage plan

Leave a Reply