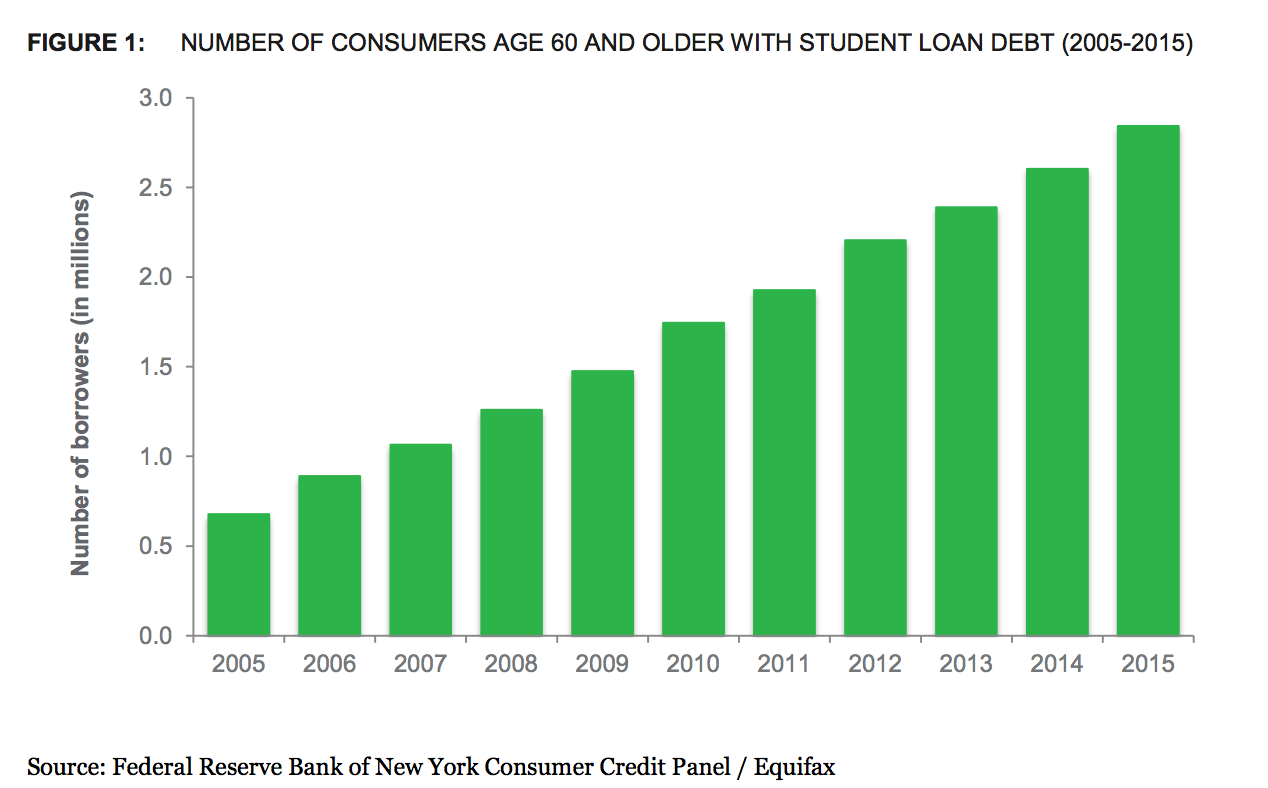

A new report from the Consumer Financial Protection Bureau (CFPB) reveals that nearly three million older adults are shouldering student loans and are struggling to pay them. Their financial security is at risk. In 2015, almost four in ten of them had defaulted on their loans.

Older adults are “the fastest growing segment of student loan borrowers,” according to Richard Cordray the director of the CFPB. Almost 75 percent of these older adults are assuming responsibility for paying for their children and grandchildren’s education. Only 23 percent of loans are for their own or their spouse’s debt. Either way, they live on small fixed incomes, and too often they can’t afford the monthly payments.

The CFPB found that older adults shouldering student loans are more likely to forego needed health care–not filling prescriptions or not visiting the doctor–because it is unaffordable. The average student loan debt older adults are bearing is now $23,500, almost double the student debt they bore in 2005.

The CFPB has further found that older adults are not being advised by the companies issuing federal student loans that the amount of their payments can be reassessed when their income changes. It also reports that when older adults default on their loans, they may be wrongly threatened with having their Social Security benefits taken away. These benefits are generally protected, though thousands of people are seeing a portion of their Social Security check seized.

According to Consumer Reports, as a general rule, debt collectors are not able to take your Social Security income to repay private student loans. However, the federal government can take a portion of your Social Security income to repay loans the federal government guarantees. That said, people facing a financial hardship and people with disabilities can seek a reduction in the amount that the federal government takes from their Social Security checks and sometimes can get the federal government to not take any money from their Social Security checks. You can learn more here from the Department of Education.

If you or someone you know has a student loan question concerning an older adult, you can email the CFPB office of older americans here. To understand your student loan repayment options, the CFPB has an online tool you can use offering a step-by-step guide.

Here’s more from Just Care:

Leave a Reply