Medicare works to ensure people access to quality affordable health care, but average out-of-pocket health care costs are still considerable. A new report from the Kaiser Family Foundation finds that individuals typically spend more than $3,200 a year just on Medicare premiums, deductibles and coinsurance. When you add in costs for services Medicare does not pay for, people spend an average of $5,500 a year out of pocket on health care or, put differently, more than 40 percent of their Social Security benefits.

Juliet Cubanski and Tricia Neuman analyzed data from 2013 to determine the amount people with Medicare spend on health care. All in, they found that spending on health care eats up about 41 percent of the average monthly Social Security check, $1,115. Average annual Social Security benefits were $13,375 in 2013 and average total income for a person with Medicare was $35,317. Their report establishes that people with Medicare have far higher annual average out-of-pocket health care costs than the Center for Retirement Research found based on 2014 data, 41 percent of their Social Security benefits as compared to 33 percent.

To be sure, the percentage of income spent on health care is far higher for people who rely exclusively or almost exclusively on Social Security for their retirement income. And, a notable portion of the 62 million people receiving Social Security benefits rely almost exclusively on Social Security for their income. More than one in five married couples and more than four in ten individuals rely on Social Security for more than 90 percent of their income, according to the Social Security Administration.

When the Kaiser Family Foundation researchers dug deeper, they found that people over 85 and women typically spent an even higher share of their Social Security income on health care than men and people under 85. People 85 and older spent on average 74 percent of their Social Security benefits on health care costs Medicare does not cover. Women over 85 spent more than men, 83 percent of their Social Security benefits as compared to 58 percent. Because Medicare does not pay for custodial nursing home care or most other long-term care services and supports, the oldest cohort of people with Medicare have especially high out-of-pocket costs.

Out-of-pocket costs for people in poor health and people with lower incomes were also higher than other people. People in fair or poor health spent an average of $6,128 on health care as compared to $5,246 for people in excellent, very good or good health. Put differently, people who could perform all the activities of daily living–bathing, feeding, toiletting, dressing and transferring–spent on average $4,673 out of pocket a year on health care, whereas people who needed help with activities of daily living spent on average $6,946.

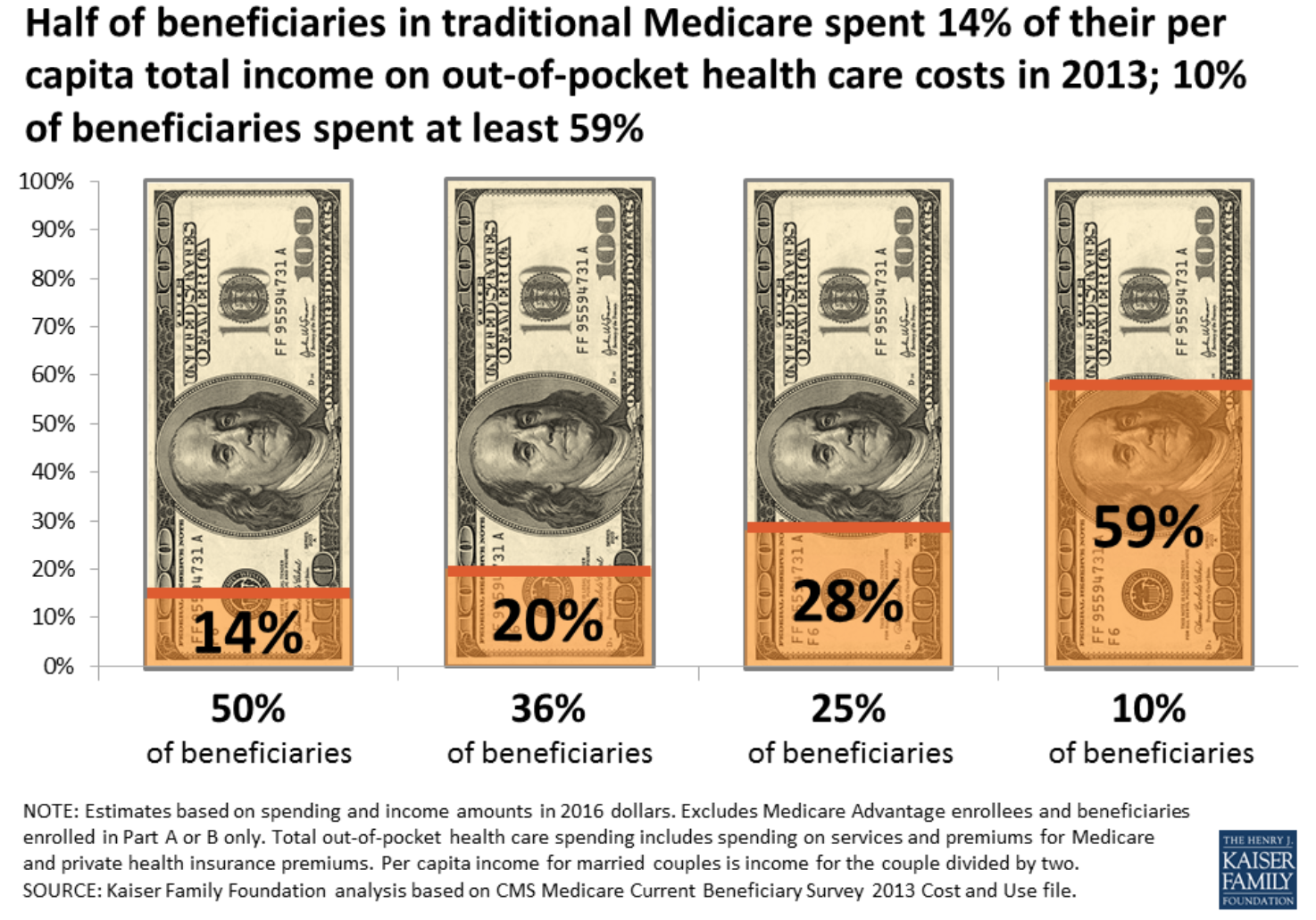

The researchers found that one in four people with traditional Medicare spent almost 30 percent of their total income on health care costs Medicare does not cover. And, one in ten people spent just under 60 percent of their total income.

We need to increase Social Security benefits if we want to ensure retirees can make ends meet and keep older adults from falling into poverty. Their situation is projected to get even worse as health care costs continue to grow.

If you want Congress to expand Social Security benefits, please sign this petition.

Here’s more from Just Care:

Leave a Reply