The latest Social Security Trustees’ annual report shows that Social Security has an accumulated surplus of about $2.9 trillion and can pay benefits in full for the next 16 years. After that, even if Congress does nothing to protect it, Social Security will be able to pay 80 percent of benefits. Older adults overwhelmingly support Social Security. It is an American success story, a highly effective anti-poverty program that improves the lives of all Americans. What not everyone realizes is that the fight to strengthen it is about intergenerational justice.

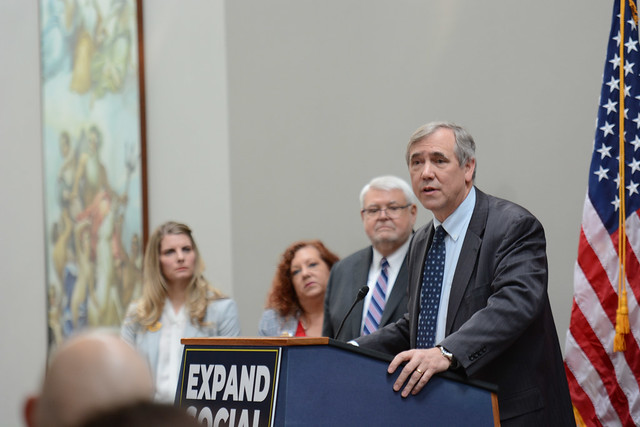

Democrats in Congress are proposing to strengthen Social Security so that it can pay full benefits for the next 75 years or more. Congressman John Larson’s Social Security 2100 Act would raise minimum Social Security benefits and adjust the formula for calculating cost-of-living adjustments so that benefits increase for everyone. It already has more than 200 co-sponsors.

Strengthening Social Security is easily affordable. Larson proposes a 2.4 percent payroll tax increase phased in slowly over several decades and also requires everyone with incomes over $400,000 to pay into Social Security up to the current cap and then on income above $400,000.

Before the 2020 election, we must broaden public support for Social Security by engaging younger generations who benefit directly and indirectly from Social Security in ways they may not yet grasp.

To win, millennials need to understand the value of Social Security to themselves, not simply that it makes their parents and grandparents more economically secure. As a result of stagnating wages, millennials, unfortunately, are the first generation to earn less than their parents. And there are other economic reasons that two in three millennials have no retirement savings. Wages have stagnated. Student debt is huge because college and graduate school education is so expensive. Thus, Social Security will protect millennials down the road, when their savings are likely to be less than those of their parents. Additionally, millennials will likely live longer and therefore have even greater dependence on Social Security.

Republicans are wrong. Younger Americans may benefit now from Social Security’s disability insurance and survivor benefits for families, but they will all definitely benefit when they reach retirement age. Americans of all ages have a stake in strengthening Social Security. If we all work together, we can ensure Social Security’s long-term political and financial viability.

Note: A longer version of this article can be found here.

Here’s more from Just Care: