Yesterday, President Trump announced that he would sign an executive order lowering prescription...

Drugs and technology

Trump could easily end high drug costs

In an op-ed for MarketWatch, Brett Arends explains that President Trump names the wrong culprit...

Trump’s executive order on prescription drugs does not...

A new Arnold Ventures poll finds that nearly nine out of 10 voters believe the government should...

When will Medicare stop letting Part D insurers drive up drug...

The Centers for Medicare and Medicare Services, which oversees Medicare, now has authority to...

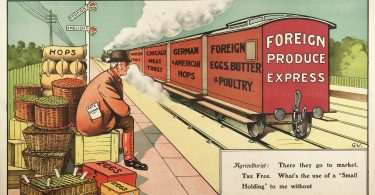

Tariffs will likely drive drug prices higher and create drug...

Most prescription drugs Americans take are manufactured outside the United States. President Trump...

2025: Government finalizes new Medicare Advantage policies

Last Friday, the Centers for Medicare & Medicaid Services (CMS) issued a final rule regarding...

AI can second-guess physicians and improve care

Regardless of what we think about the benefits of using artificial intelligence (AI) for medical...

Will Trump give his supporters the lower health care costs they...

As we know, Trump supporters, like most Americans want to see lower prices on basic necessities...

President Trump threatens Pharma with tariffs

President Trump has spent his first few weeks in office undoing much of what President Biden had...

Trump signs executive order creating “MAHA” commission

President Trump signed an executive order creating a Make America Health Again (“MAHA”)...