As they age, most older adults living in their communities rely primarily on family and other...

Medicaid

Medicare and Medicaid are more cost effective than commercial...

In his latest post for the New York Times, Austin Frakt makes the case that both Medicare and...

Republican Medicaid reform proposals devastating

As a pediatrician, I prioritize the importance of Medicaid in child health. But as an American I...

Programs for vulnerable Americans on chopping block

President Trump has released his budget, and it puts programs for vulnerable Americans on the...

The latest on ACA, Medicaid and Medicare

This year, Trump’s budget does not include cuts to either Social Security or Medicare. But...

What becomes of Medicare and Medicaid after the presidential...

In an opinion piece for the Wall Street Journal, Drew Altman, president of the Kaiser Family...

At least 12 million uninsured are eligible for free or low-cost...

More than 12 percent of U.S. residents under 65 were uninsured in March 2015, according to a new...

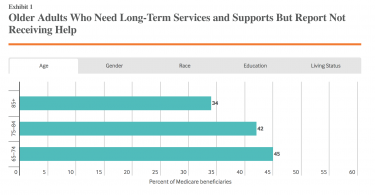

Who provides long-term services and supports?

Most older adults choose to remain in their communities as they age as long as they can. In order...

Medicare and Medicaid at 50: Their roles in our health care...

A 2015 article in Health Affairs by Drew Altman and Bill Frist speaks to Medicare and Medicaid at...

John Oliver: Republicans are blocking access to health insurance...

In this video segment, John Oliver explains how the Supreme Court hurt millions of Americans by not...