A new paper by Steffie Woolhandler et al. in the Annals of Medicine exposes our health care...

Health insurance

Free local resources to help older adults

If you’re looking for free local resources to help older adults, your local Area Agency on Aging...

To save money on your care, consider using a free health clinic

Because health insurance no longer covers large portions of people’s health care costs...

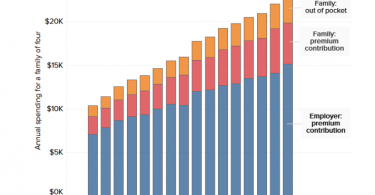

Health care costs continue to rise faster than inflation

Americans want Congress to address out-of-control health care costs; these costs have been...

Traditional Medicare offers better home care benefits than...

If you have Medicaid or can afford supplemental coverage to fill gaps in traditional Medicare...

Do you need care? Why should your health insurer decide

In a Washington Post op-ed, William E. Bennett Jr., a gastroenterologist and associate professor of...

Private health insurers don’t let you budget for your care

Kaiser Health News reports that people with the wherewithal to shop around for affordable health...

Health care information confuses people

The Center for Retirement Research blog focuses on how health care information tends to confuse...

Major problems with Medicare Plan Finder

Not long ago, advocacy groups called out the Centers for Medicare and Medicaid Services (CMS) for...

Private insurers are the biggest obstacle to guaranteed...

Although not all the Democratic presidential candidates support Medicare for All, most understand...