The Program of All-inclusive Care for the Elderly (PACE) is a home and community-based program...

Medicaid

2022: Programs that lower your health care costs if you have...

Medicare only covers about half of a typical person’s health care costs, leaving people with...

How a for-profit program that should provide all-inclusive care...

Medicare’s Program of All-inclusive Care for the Elderly or PACE has been a godsend for a small...

Coronavirus: The nursing home tragedy

Jay Caspian Kang writes about Covid-19 and the nursing home tragedy in the US in an opinion piece...

2021: Programs that lower your health care costs if you have...

Medicare only covers about half of a typical person’s health care costs. So, even with Medicare...

Dental fraud: How to protect yourself

Daryl Austin writes for Kaiser Health News about dental fraud. Yes, dentists sometimes identify...

Coronavirus: More home and community-based services needed

For all the tragedy that Covid-19 has wreaked on this nation, there are a few silver linings...

Government-administered long-term care insurance is long overdue

Since the start of the novel coronavirus pandemic, more than 46,000 people have died in nursing...

Can you protect nursing home residents in a profit-driven system?

A story in The Guardian about corporate entities that buy up nursing homes, with the goal of...

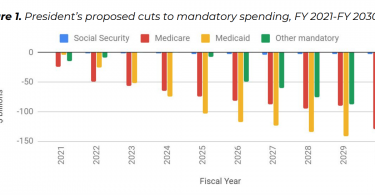

President Trump’s 2021 proposed budget would most hurt...

Monique Morrissey writes for the EPI blog about President Trump’s proposed 2021...