When it’s time to sign up for Medicare, information can be confusing. Before enrolling in...

Medicare

Why traditional Medicare remains so popular

Uwe Reinhardt, PhD, writes Why Many Medicare Beneficiaries Cling to an Allegedly Worse Deal in JAMA...

What care do you want if you become seriously ill? Talk to your...

One fourth or so of Medicare annual spending–about $33,500 a person–goes to the cost of...

What’s the Medicare Part B premium in 2016?

Until recently, the Medicare Part B premium (medical insurance) was the same for everyone...

If your doctor leaves your Medicare Advantage plan mid-year, you...

There are reasons you should not trust your health plan’s provider directory, and you can...

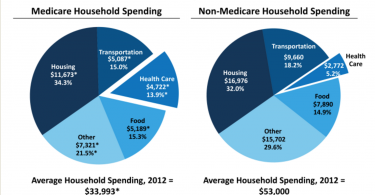

People with Medicare spend significantly more on health care...

Many people do not realize that health care costs are almost 14% of household income for people...

Three reasons why you can’t choose a health plan...

If you’re struggling to choose a health plan that’s “right for you,” you’re in...

Don’t let your doctor intimidate you: A personal story

It was a balmy fall day last year, when I walked through the surprisingly creaky door of a...

Medicare covers depression screenings

Depression can be crippling, disrupting people’s daily lives and normal functioning. But it...

Health plan networks limit access to care

One of the biggest problems with health insurance companies is that they generally offer health...