More than 30 million Americans have lost their jobs as a result of the novel coronavirus. Older adults are being hit especially hard in the job market, writes Alicia Munnell for MarketWatch. Some believe that older adults will be least likely to get jobs when the economy reopens. The pandemic is likely to deepen a projected retirement crisis.

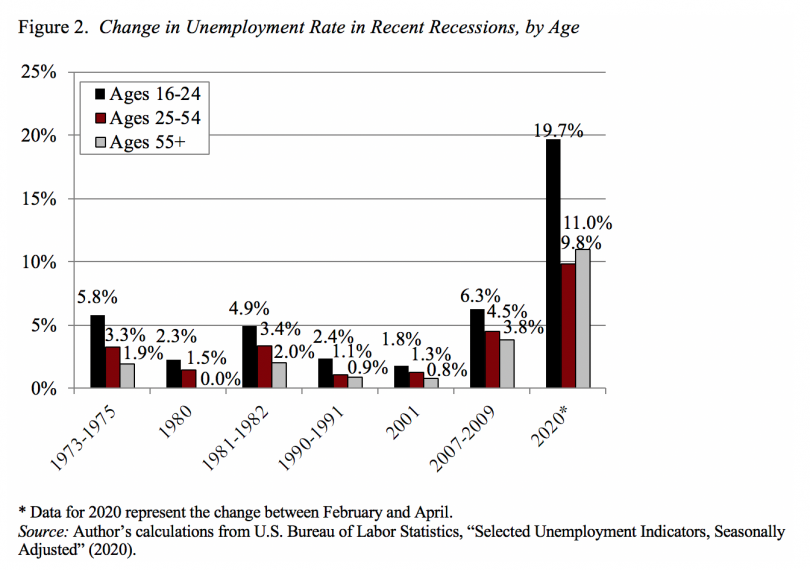

Today, unemployment is almost at 15 percent. Usually, unemployment hurts the youngest working Americans most, 25 to 54 year olds next, and older adults least. This time around, the youngest Americans, who tend to work in the hospitality and other service industries have again been hit hardest. But, after them, Americans 55 and older have been most affected.

The unemployment rate for Americans 55 and older rose to 13.6 percent in April. It was at 2.6 percent less than five months ago, in January. Add to high unemployment a decline in retirement savings and many more older adults are at serious risk in retirement.

It used to be that older adults held onto their jobs longer than younger adults, in part because they had a longer track record. But, they also tend to earn higher wages. And, COVID-19 puts older adults at higher risk of infection. Age discrimination could also be contributing to job loss for older workers.

Older workers are typically least likely to be hired when the economy is back in swing. After the great recession 12 years ago, older workers spent twice as long finding work as younger workers. On average, they waited nine months to find work. More than four in ten (41 percent) were still looking for work 18 months after the Great Recession. Those who were rehired took steep pay cuts. Employers believe they can get equally or more skilled younger workers at less cost.

To be sure, unemployment or employment at lower wages before you reach your full Social Security retirement age generally affects the amount you will receive in Social Security benefits.

Here’s more from Just Care:

…some just gave up and opted for early retirement taking a hit on our Social Security benefits.

I remember waling into interviews nicely dressed and groomed and seeing the expression on the interviewer’s face (who could have been my son or daughter) that pretty much said “oh an older person”. I’ve heard all the “excuses”, the most infuriating of which was I’m “overqualified”, which really means they don’t want to pay you for your knowledge and experience. Got so many of the “we’ll call you” responses I could see the handwriting on the wall.

Fortunately (and unfortunately) I was also dealing with two types of severe arthritis and circulation issues which were getting worse over the years and which put any job that had a major physical requirement or even standing for long periods of time (pretty much what I had been doing for the 20 years beforehand) off limits. To change careers to something less physically demanding which wasn’t an occupation in decline, would have meant going to school, possibly for four years, in something related to computer technology (I am pretty much self taught in 3D graphics and workstation design/setup but employers want to see it on that piece of paper you hang on a wall), an expense I definitely could not afford. Even with that I would still have to deal with ageism, as the tech sector is known to be one of the worst.

I was advised by a number of people to apply for SS disability which, after several appeals and exams, I finally qualified for. Yes it meant periodic re-evaluation of my status (every 18 months) but the trouble was worth it and it has since transitioned to SS retirement (though lower than I would have received had I continued working, particularly if I could make it to age 71)