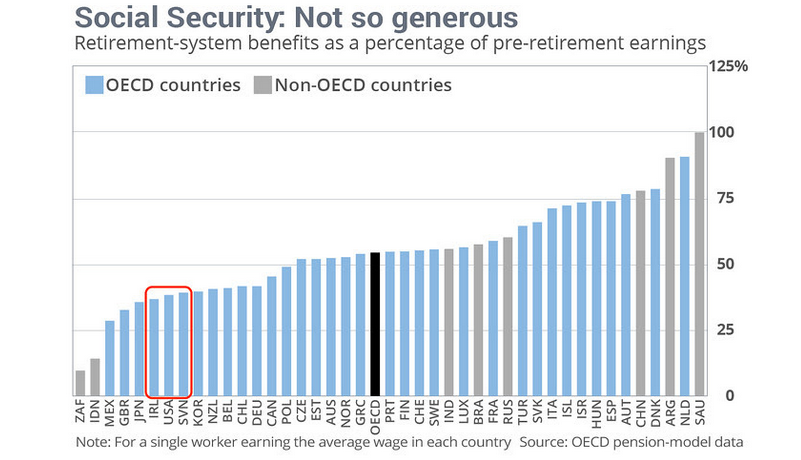

A new chart from the Organization for Economic Cooperation and Development highlights how meager retirement benefits are in America. As compared to 33 other countries, the United States ranks 27th, almost at the bottom, near Mexico, Slovenia and Korea. In short, comparatively, Americans have stingy Social Security retirement benefits.

To be clear, the OECD chart illustrates that Social Security only replaces about 40 percent of the typical worker’s pre-retirement earnings. According to Alicia Munnell, Director of the Center for Retirement Research at Boston College, the OECD confirms that “the U.S. provides some of the lowest benefits in the developed world.”

People need to recognize that Social Security is backed by a trust fund containing $2.8 trillion. That money is the people’s retirement money. The federal government would be commiting embezzlement if cuts occur before this money is repaid. The status of the money in the trust fund changes from borrowed to stolen should cuts happen.

I’m not sure where Slovenia is. I am sure that at 65, working 84 hours a week and paying back $75k in student loans, there could be some improvement ahead. As if SS isn’t a poor enough retirement, the govt seizing it for student loans I have been paying on since 2004 is criminal.

1)Do you think you’ll have enough money for a cootmrfable retirement?Does not apply. I love my career as an artist and hope to die with the tools of the trade in my hands.2) Do you plan on receiving the social security benefits that have been promised to you?Sure, I’m a boomer. I plan to tap in at 62. But my intent is to pass it along every month to someone in one of the following generations. There’s some delicious irony there.3) What % of your income do you save today for retirement?When I work my savings rate is usually around 40-50%. But let me say that life so far has been like a long summer vacation. I have taken as much as a year to enjoy myself and recharge my batteries several times in my adult life. I rarely reject an offer to go river rafting or fishing (which are very low cost and high enjoyment activities). On the financial side, I sold my suburban home four years ago and rent a small farm now. The cash is well invested (I hope) since it has more than doubled in that time. To buy in my locale would cost me at least triple what I now pay in rent. 4) Where would you like to retire?I’m an avid, no, really I’m a compulsive food gardener and tree grower. Soil, water, four real seasons and open spaces blow my skirt up. I’ll stay in the USA and take my chances with the coming times since my tribe is here. 5) How old are you, and what age do you plan on retiring?The answer to part one is that I’m just about to turn 61. For part B see the above.A little rambling: The real goal is to have a good life. Keep it simple and full of heart. Be joyful doing vigorous work. Eat healthy food not poisonous crap. My key to having enough money has been to tighten down the outflow spigot rather than exert myself in the mind numbing quest for big bucks. Oh yeah, exchange goods and services with others because the return is much greater (though a bit difficult to quantify). You have all seen pictures of some ancient and very wrinkled peasant in bib overalls holding a bunch of grapes with a twinkle in his eye and a wise smile on his face. This is not a bad goal. Finally, it is better to die deservedly well loved than rich.

WISELY SPOKEN & FUN TO READ. THX!!! 🙂

It’s worse than what anyone realizes. If the republicans win the presidential election they intend to get rid of Social Security altogether along with Medicare, Medicaid and Planned Parenthood. You won’t have to worry about a COLA. It will be for all intents and purposes be gone or just a shadow of what it once was.