The Kaiser Family Foundation has new Medicare data: Who’s enrolled, costs, trends and more. Not surprisingly, Medicare spending represents a large share of total government spending (13 percent of the federal budget in 2021), and spending will rise over the next few decades as older adults represent a larger share of the population.

Today, more than 65 million Americans benefit from Medicare, about 20 percent of Americans. By 2060, more than 93 million Americans are projected to benefit from Medicare.

In 2020, about 17 percent of the US population were people over 65–56 million. By 2060, people over 65 will constitute 25 percent of the US population. One third of people over 65 will be over 80.

Medicare per person and overall spending have grown enormously in the last 20 years as health care costs have increased. Per person spending is up to $15,700 from $5,800 in 2000. Overall spending is now at $744 billion a year, up from $200 billion in 2000. And, spending is projected to rise to more than double that, $1.7 trillion, by 2033.

A lot of Medicare’s increased cost can be attributed to Medicare Advantage. Payments to these health plans has tripled in the last decade, from $137 billion to $403 billion. And, the government overpays these plans—as much as 20 percent more than Traditional Medicare, according to a new study out of USC. The percentage of people enrolled in Medicare Advantage plans has doubled from 25 percent to 50 percent.

People with Medicare are using more services, and costs of services are rising significantly. Costs are also up significantly since 2000 because Medicare began covering prescription drugs in 2004. That said, Medicare pays significantly less for most services than private insurers because it negotiates provider rates.

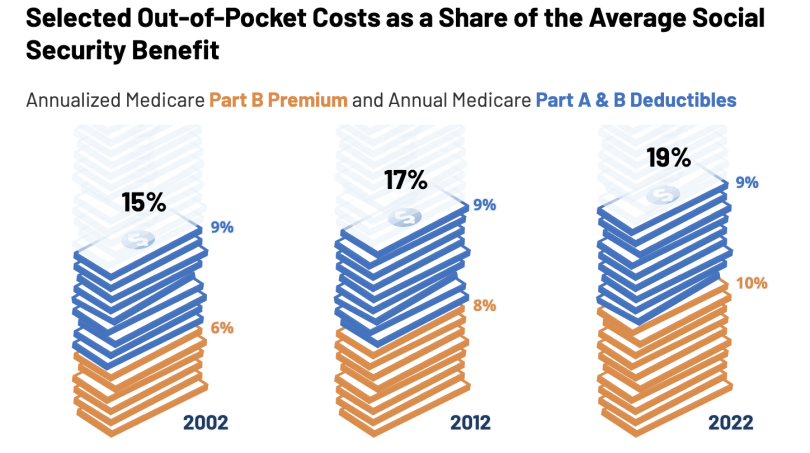

Today, people with Medicare pay a lot more for their care than in the past. Medicare Part B premiums consume 10 percent of the typical Social Security benefit, up from 6 percent. If you include Parts A and B deductibles, 19 percent of a typical Social Security check goes to Medicare costs, up from 15 percent. And, then there’s the cost of long-term care at home or a nursing home, dental, hearing and vision care, and prescription drug coverage and copays.

Here’s more from Just Care:

- Six tips for keeping your drug costs down if you have Medicare

- What are your Medicare premium and other costs in 2023?

- Beginning at age 72, you must withdraw money from your retirement accounts

- 2023: Medicare Part D prescription drug coverage and costs

- Retirement Reboot: What you should know and how to plan ahead