Today the Social Security trust fund has about $2.8 trillion. But, by 2033, if nothing is done to increase the amount in the trust fund, it will have spent down its assets and will only be able to pay about 75 percent of scheduled benefits. As it is, U.S. benefits are stingy as compared with other wealthy countries.

According to the Center for Economic Policy and Research (CEPR), one driver of this future shortfall in the Social Security trust fund is dramatic widening of income gaps in the last three decades. The workers earning the most money have seen faster wage increases than other workers. Consequently, more income is escaping tax than originally projected, and the Social Security trust fund has collected less revenue than needed.

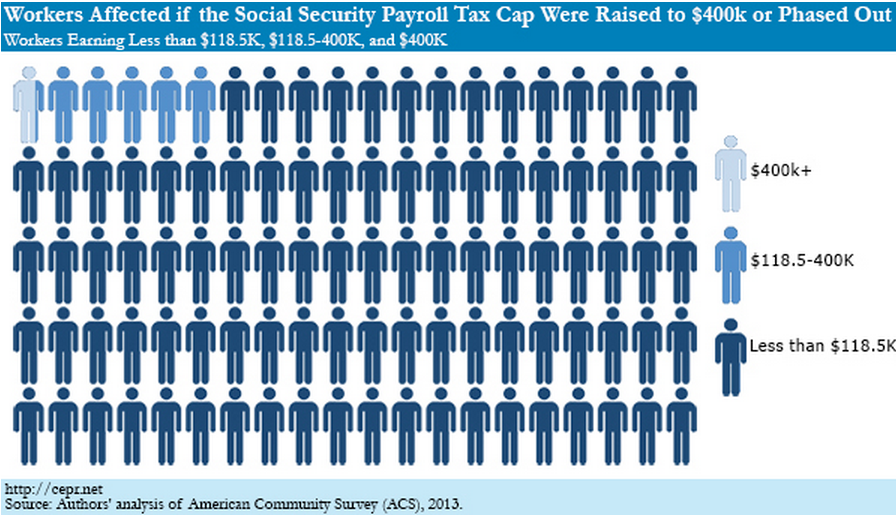

A simple solution for building up the Social Security trust fund to what is needed down the line is to raise the cap to the level originally intended by Congress and President Reagan. By so doing, 70-80 percent of the projected trust fund shortfall would vanish. Based on the Census data, CEPR projects that only one in 15 workers would be affected if the Social Security cap were lifted. Only one in 32 women would pay more, and only one in 43 Latinos would pay more.

Lifting the cap is not only fair, it would eliminate the need for benefit cuts or tax increases on the middle class. And a large majority of Americans support it. Isn’t that the right way to shore up Social Security?

If you agree, click here to urge Congress to require millionaires to pay their fair share into Social Security.

A simple solution: eliminate the cap on all income.

Greed is amazing! Everyone should have to pay taxes on any income, including the filthy rich.

I absolutely agree with the people who posted, earlier. The cap on payments into SS should be removed, entirely. Will our obstructionist congress agree to this plan? No, they will not, as so many in congress are bought and paid for by the 1% and other special interest groups.

You have to admit, we have the “best congress that money can buy.”