For anyone who questions the value of commercial health insurance and wants to understand how to...

Medicare

ACA repeal means higher costs for people with Medicare

There has been a lot of focus on the implications for working people of the Republican...

Dems should unite behind Medicare for all

The Republican leadership in Congress is still planning to kill the Affordable Care Act, with no...

Republican New Year’s Resolution: Dismantle Medicare

The New Year is a time of resolutions. Consistent with that tradition, the Republican New...

Government still overpays commercial Medicare plans

At a recent meeting of the Medicare Payment Advisory Committee (MedPAC), commissioners learned...

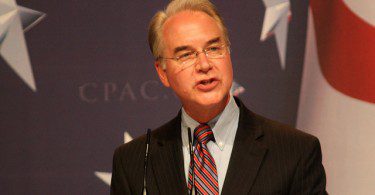

Trump HHS pick is fierce opponent of Medicare and ACA

President-elect Trump‘s choice of Tom Price to head the Department of Health and Human...

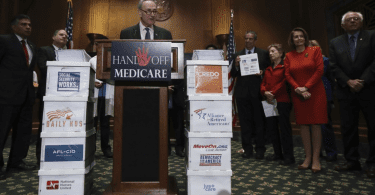

One million “hands off Medicare” petitions delivered...

On Wednesday, Social Security Works, Just Care, and several other organizations delivered more than...

Medicare remains more efficient than private insurance

In September 2011, in a post first published in Health Affairs, I explained why Medicare is more...

Vermont prepares for all-payer health system

Democratic Governor of Vermont, Peter Shumlin, and Republican Governor-elect of Vermont, Phil...

Thankful for traditional Medicare? Call Paul Ryan

Of all the health care plans in America, traditional Medicare does the most to ensure people get...