Democrats and Republicans in Congress have reached agreement on a budget deal, which fixes a glitch...

Social Security

New data reveals that higher Social Security income helps the...

As the population ages, it’s important that our policies help to prevent, reduce or delay...

No Social Security increase in 2016 at substantial cost to most...

Every year but two for the last 40 years, people have seen a cost-of-living increase in their...

On its 80th birthday, Social Security is beloved by young and...

Americans may have diverging views on endless numbers of policy issues but, when it comes to Social...

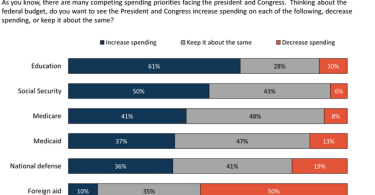

Vast majority of Americans want to expand Medicare and Social...

A new Kaiser Family Foundation survey of Americans reveals that the public views Medicare and...

Reich: We can afford to expand Social Security

Social Security is not in trouble, explains former U.S. Secretary of Labor, Robert Reich. In fact...

What will your Social Security benefits be when you retire?

What will your Social Security benefit be when you retire? Knowing how much you will receive from...

6.2 percent Social Security tax holiday begins February 11 for...

Most people pay a Social Security tax of 6.2 percent on their income throughout the year, on every...

President Obama’s 2016 budget relatively good on Social...

While the President’s proposed Medicare policies leave a lot to be desired, he gets it right on...

More Americans planning to work past age 65

More Americans are planning to delay retirement and work longer. A 2014 CBS news poll shows...