It’s not unusual for health insurance to cover $11 on a $125 mental health visit, reports O...

Health conditions

Dental care is increasingly unaffordable

The cost of dental care has become prohibitively expensive for the vast majority of Americans. In a...

Family caregiving: Costly, lonely and stressful work

Most Americans want to grow old in their homes, where they are most comfortable, not in a facility...

If you need long-term care services, how will you get them?

The majority of older adults will need long-term care services at some point. But, caregiving costs...

Every American needs a primary care doctor

The National Academies of Sciences, Engineering and Medicine (NAS) just released a report urging...

Plan ahead for a hospital visit: Talk to the people you love...

Few of us think about preparing in advance for a hospital visit, for someone we love, let alone...

Free local resources to help older adults

If you’re looking for free local resources to help older adults, your local Area Agency on Aging...

Older adults are far more likely to die from the flu

A new CDC study provides yet another reason for older adults to get the flu vaccine. Specifically...

Could you pay more in Medicare Advantage than traditional...

Many people with Medicare opt for a Medicare Advantage plan, a commercial insurance plan that...

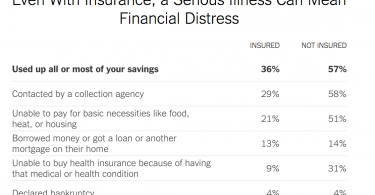

Commercial health insurance fails to protect people from...

People not yet eligible for Medicare are generally expected to “pick the commercial health...