If your income is low, you might be able to get help paying your Medicare premiums and copays...

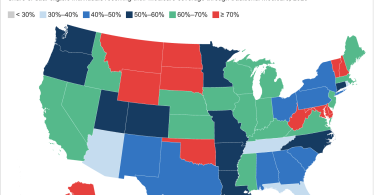

Medicaid

Medicaid is a benefit for the middle-class

Many people do not appreciate how important Medicaid is for middle-class families, reports Ron...

Some hospitals now provide at-home rehab services

Felice J. Freyer reports for Kaiser Health News on how some hospitals now provide at-home rehab...

2025: Programs that lower your costs if you have Medicare

Medicare only covers about half of a typical person’s health care costs, leaving people with...

Getting public assistance? Beware of Medicare Advantage flex...

Maya Goldman reports for Axios on the risks of Medicare Advantage flex cards for people getting...

2024: Programs that lower your health care costs if you have...

Medicare only covers about half of a typical person’s health care costs, leaving people with...

Critical home care is no longer affordable for most people and...

Caring for an older person with multiple needs can take a toll physically, emotionally and...

Coronavirus: Should you get the 2023 booster shot?

The next Covid-19 booster shot should now be available from your local pharmacy, health clinic or...

People with both Medicare and Medicaid can get Traditional...

More than 12 million Americans with Medicare also have Medicaid. These “dual-eligibles”...

Medical debt rising for people who pay through their credit cards

Millions of people max out their credit cards, and an increasing number max out because of a costly...