Kaiser Health News reports on a ghastly phenomenon that appears all too common for people with...

Medicaid

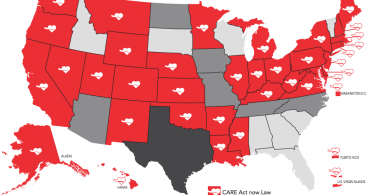

CARE Act assists family caregivers

About seven in ten older adults need long-term care at some point. In many cases, it is a family...

Before choosing a nursing home, check out Nursing Home Inspect

If you are looking into nursing home options, Pro Publica has an online tool worth exploring...

Protect your eyesight: Free and low-cost vision care

Your ability to see well is precious. But, your vision is likely to deteriorate as you age. Some...

Free and low-cost ways to address hearing loss

While our hearing is likely to weaken with age, there are things we can do to address hearing...

How to get free or low-cost dental care

Because dental care can be so expensive and most insurance—including Medicare—does not cover...

Are commercial Medicaid and Medicare plans a good taxpayer...

How do we know whether commercial Medicare and Medicaid health plans are a good taxpayer...

Congress must protect our community health centers

Every Thursday morning, I wake up excited for the 14-hour day I’m about to begin. My Thursdays...

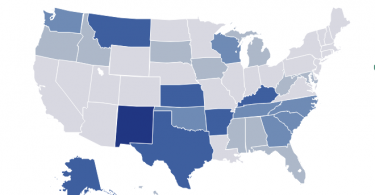

Medicaid: Why it matters to all of us

Medicaid, with “aid” at the end, is a federal-state insurance program established to help...

ACA reduces medical divorces

Among the Affordable Care Act’s many benefits, it’s common knowledge that it has...