The 2018 standard monthly Medicare Part B premium, which covers medical and outpatient...

Medicare

If you want easy health care access and good quality care, you...

When you’re considering your Medicare health plan options, if you want easy health care...

The similarities between banking and health care

Judith Garber of the Lown Institute reports on the similarities between banking and health care...

Medicare Open Enrollment: Consider changing health plans

Medicare Open Enrollment begins on October 15 and runs through December 7. During this time...

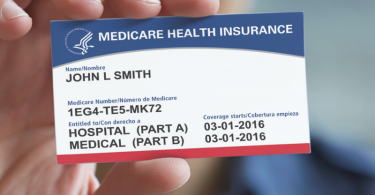

New Medicare card in the works

The Centers for Medicare and Medicaid Services, CMS, is preparing to release a new Medicare card to...

2018 Social Security benefits should rise, but checks may not

One of the strengths of Social Security is that benefits are adjusted annually to offset increases...

What are Accountable Care Organizations?

Medicare has been experimenting with new payment models to bring down health care costs, improve...

What to do if your in-network doctor goes out of network?

It used to be that our health care system valued continuity of care. Insurers covered care from...

Three things to consider about end-of-life care

If you’re caring for someone at the end of life–with a life expectancy of no longer...

No projected 2018 increase in standard Medicare premium

[Editor’s note: Medicare 2018 premium information released, November 20, 2017.] The July...