The Kaiser Family Foundation just released a report detailing the many data gaps in Medicare...

Medicare

Escort requirements keep people from receiving medical procedures

Paula Span reports for the New York Times on outpatient procedures that require patients to have...

The choice between traditional Medicare and Medicare Advantage:...

If all things were equal, the choice between traditional Medicare and Medicare Advantage is easier...

Congress must stop the Medigap madness

On one hand, “Medigap,” health insurance coverage that supplements traditional...

Don’t rely on Mark Cuban’s Cost Plus Drugs for the...

I promoted Mark Cuban’s Cost Plus Drugs a while back as a way to get low-cost generics. As it...

Pharmacy Benefits Managers continue to drive up costs

Most people likely do not even know what a Pharmacy Benefit Manager (PBM) is. PBMs allegedly add...

People with Medicare are less likely to get dental care

Only about half of older adults in the US have health insurance that covers dental care, according...

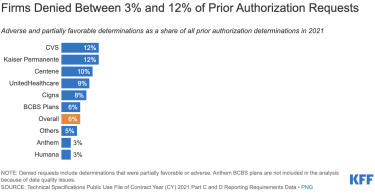

Medicare Advantage plans denied two million prior authorization...

Imagine that you were given a wad of cash to deliver a service when necessary. And, it was in your...

Medicare patients with liver cancer face $10,000 in...

Even with Medicare, out-of-pocket costs for people with liver cancer can be unaffordable. A recent...

Case study: Costco saves one couple hundreds of dollars over...

If you ask me, often the smartest way to save money on prescription drugs is to import them from...