In January 2017, the Centers for Medicare and Medicaid Services, CMS, will launch a new initiative...

Your Coverage Options

PhRMA fights states on drug pricing

Drug prices are rising at crazy rates; in 2015, almost one in three brand-name drugs saw a price...

Telehealth on the rise

Telehealth or telemedicine–the provision of care through telephone or digitally, including...

Is involuntary enrollment in Medicare Advantage plans the new...

It has been the norm that when people first go on Medicare, they are automatically enrolled into...

The VA health system: Best in class and under fire

Some might say with good reason that the Veterans’ Health Administration or the...

Three things to think about when enrolling in Medicare

When it’s time to sign up for Medicare, information can be confusing. Before enrolling in...

When to claim Social Security benefits

When deciding when to stop working and when to claim Social Security benefits, there is a lot to...

John Oliver: Be careful about how you save for retirement

In a recent Last Week Tonight segment on retirement plans, John Oliver warns that we need to be...

Why traditional Medicare remains so popular

Uwe Reinhardt, PhD, writes Why Many Medicare Beneficiaries Cling to an Allegedly Worse Deal in JAMA...

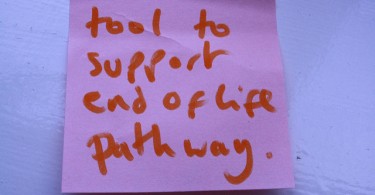

What care do you want if you become seriously ill? Talk to your...

One fourth or so of Medicare annual spending–about $33,500 a person–goes to the cost of...