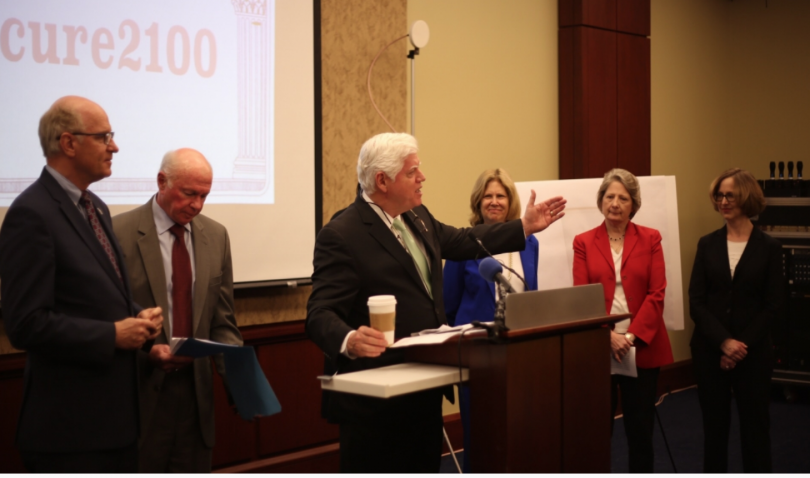

Today, Franklin D Roosevelt’s birthday, Congressman John Larson (D-CT), Chair of the US House of Representatives’ Social Security Subcommittee of the Ways and Means Committee introduced the Social Security 2100 Act. If passed, it would be the biggest improvement to Social Security in more than 35 years, increasing benefits and strengthening the Social Security Trust Fund. And, it already has more than 200 co-sponsors!

The Social Security 2100 Act increases Social Security benefits for everyone an average of 2 percent. And, it ensures people’s benefits rise appropriately with inflation. Historically, the inflation calculation has not taken into consideration the basket of services older people buy, particularly health care services, which have risen in cost faster than other services.

The Act recognizes that no one should retire in poverty; it helps people with low incomes by raising the minimum monthly Social Security benefit to 25 percent above the federal poverty level. At the same time, it protects people so that any increases in benefits will not affect people’s eligibility for Medicaid or reduce their SSI benefits.

And, it lifts the cap on Social Security payroll contributions so that wealthy Americans pay their fair share of contributions throughout the year. Everyone with incomes above $400,000 would make payroll contributions.

The Act also reduces taxes for 12 million people receiving Social Security benefits with incomes over $25,000 and under $50,000 and couples with incomes over $50,000 and under $100,000. Today, individuals receiving Social Security benefits are taxed on their benefits if they have additional individual income over $25,000; couples are taxed on their benefits if they have additional income over $32,000.

The Act recognizes that Social Security, is a cost-effective government program that provides critical economic security to tens of millions of Americans. Americans earn their benefits through payroll contributions.

The Act also ensures that Social Security remains solvent for generations to come. Beginning in 2020, the payroll contribution for workers and employers would increase incrementally to 0.6 percent each by 2043, or a total of 7.4 percent from 6.2 percent today. This means an additional average worker contribution of .50 cents a week in 2043.

Congressman Larson and the bill’s cosponsors have listened to their constituents. More than seven in ten Americans support expanding Social Security.

If you want Congress to expand Social Security, please sign this petition.

Here’s more from Just Care:

What’s interesting about this legislation is that it eliminates most of the marriage penalty in the Social Security tax. Democrats should point this out when “family friendly” Republicans attack it.

another item that should be included in any new social security law is that a spouse should be able to continue receiving his or her spouses benefits along with their own if the spouse worked and receive benefits of their own. If a spouse dies under current law, you can receive only one benefit although the other worked and paid into social security.