If you’ve been to the hospital at any time in the last several years–be it for a scheduled procedure or an emergency room visit–it’s more than likely that you’ve been hit with bills that you never expected. Inevitably, if you’re enrolled in an HMO or PPO, the doctors treating you at an in-network hospital are not all in your health plan’s network, and your health plan will not cover that care. Here’s how to protect yourself against unexpected medical bills.

If you have traditional Medicare, you can avoid unexpected medical bills in hospital. Traditional Medicare covers all your hospital care. Health insurance through an employer or the Affordable Care Act or a Medicare Advantage plan almost always restricts your coverage to in-network doctors and hospitals. But, they do not guarantee that only in-network doctors will treat you.

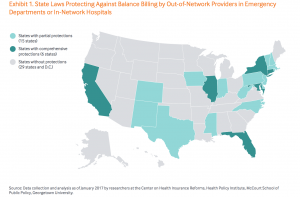

Neither federal nor state law requires all doctors at an in-network hospital to be part of your health plan’s network. And, worse still, these out-of-network doctors can charge you tens of thousands of dollars for the care they provide, unless you live in a state with strong consumer protections.

While 21 states offer some consumer protections, a new report for the Commonwealth Fund finds that only six states do a good job of protecting patients who end up in the hospital, either for a scheduled procedure or in an emergency–California, Connecticut, Florida, Illinois, Maryland and New York. These states with the best consumer protections either forbid out-of-network doctors from billing additional charges to patients or require insurers to protect patients from the excess charges and resolve the excess charges directly with the out-of-network doctors. Note: People enrolled in self-insured employer plans (ERISA) are exempt from state regulations and not protected under state law.

New York State’s Department of Financial Services reports that unexpected medical bills for out-of-network care are the biggest health-insurance related complaint the Department receives. Too often, services from pathologists, anesthesiologists and radiologists are out of network, and patients are wholly responsible for the cost. Consumers Union offers a case study in this report.

In New York, out-of-network doctors must give notice to patients that they are providing services. Patients can then insist on receiving services from in-network doctors. Without this notice, patients are only responsible for the in-network cost, and insurers are responsible for settling disputes directly with doctors.

No matter where you live, you should let the hospital know that you want to receive services only from doctors in your health plan’s network. And, before surgery, repeat that request to help ensure that the anesthesiologist, pathologist and radiologist are all in your plan’s network.

Here’s more from Just Care:

Doctors sign contracts with most MA plans. You suolhd ask, Are my doctors in the network? And you might ask your doctor’s business manager/contract manager if the MA pan pays its bills on time.