The Consumer Financial Protection Bureau, an arm of the federal government, reports that almost four million older adults owe as much as $54 billion in medical debt. Of those, 98 percent have either Traditional Medicare or Medicare Advantage. What’s truly shocking is that a lot of that debt is money they should not be paying.

Virtually all older adults have Medicare, and seven in 10 report having additional insurance, either Medicaid, retiree coverage from a former employer or supplemental insurance such as Medigap. Yet, between 2019 and 2020, there was a 20 percent increase in the amount of unpaid medical bills of older adults, from $44.8 billion to $53.8 billion. That’s about 25 percent of all medical debt among adults at that time.

The average amount older adults owed in 2020 was $13,800, although half of them owed less than $1,500. In 2019, they owed an average of $11,700, with half owing less than $1,200. The jump is confounding since fewer people got medical care in 2020 than in 2019 as a result of Covid-19. The jump is also greater than the increase in Medicare premiums and overall health spending.

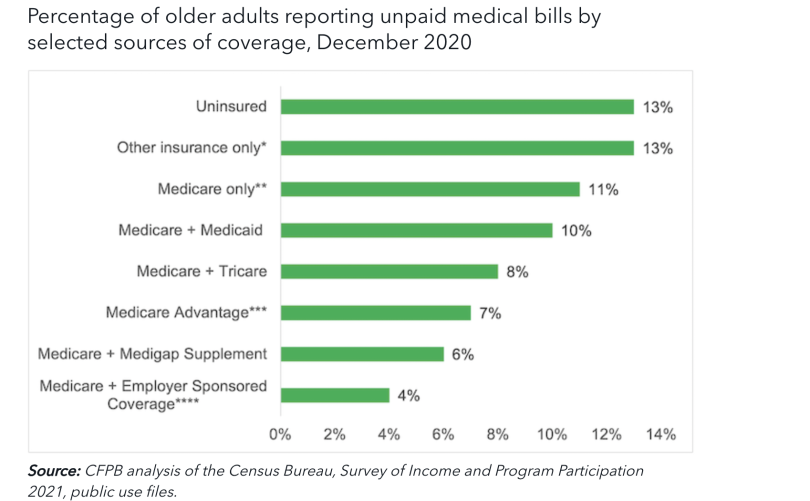

The Consumer Financial Protection Bureau found that a smaller percentage of people in Traditional Medicare with supplemental coverage, either Medigap or retiree coverage from a former employer, had unpaid medical bills than people in Medicare Advantage.

There is a substantial chance that a lot of these medical bills are erroneous. Physicians and other health care providers sometimes wrongly bill Medicare patients extra. You should never pay an unexpected bill from a physician without first checking with your local State Health Insurance Program (SHIP).

If you have both Medicare and Medicaid, you should have no or virtually no out-of-pocket costs for all Medicare-covered services. And, physicians and other health care providers are prohibited from charging you directly, except for a small copay in some states. Do not pay those bills. Call the doctors office and assert your rights; you might also want to file a complaint with Medicare.

If your health care provider sends an erroneous bill to a bill collector or credit reporting company, it could harm your credit. Call your local member of Congress and seek help correcting your credit report. If you are not able to get additional care because of your medical debt, let your member of Congress know.

Congress allows bill collectors to go after people with Medicare with near impunity. The bill collectors should be penalized for going after people with Medicare without taking appropriate steps to ensure that bills are accurate. Meanwhile, people with Medicare, including people in Medicare Advantage plans, often pay these erroneous bills, deplete their savings and then struggle to afford the care they need.

Here’s more from Just Care:

- Medical debt more prevalent among Medicare Advantage enrollees than traditional Medicare enrollees

- People in Medicare Advantage struggle to afford their care

- The deadly consequences of out-of-pocket drug costs

- Medicare Advantage plans use AI to deny care

- 2022: Programs that lower your health care costs if you have Medicare