A new Kaiser Family Foundation issue brief reports that out-of-pocket prescription drug costs are soaring for people with Medicare Part D, particularly for people who use a lot of medicines. In 2020, the Part D benefit will shrink, so out-of-pocket costs are sure to rise further.

Nearly 45 million people with Medicare–70 percent of the Medicare population–are enrolled in Medicare Part D, either in a stand-alone plan if they have traditional Medicare or in a plan that they get through their Medicare Advantage plan.

On average, people with Part D spent $486 out of pocket for their prescription drugs in 2017. But, beware! If you need expensive medications, your out-of-pocket costs with Medicare Part D can be thousands of dollars. Two percent of people with Part D spent an average of $3,214 out of pocket in 2017.

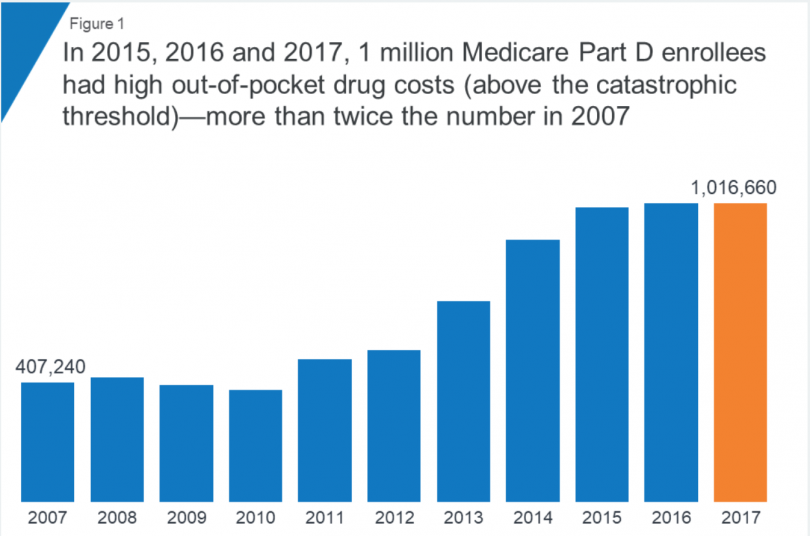

One million people–one in fifty with Medicare Part D–had out-of-pocket drug costs above the Part D catastrophic cap in 2017. Once you reach that cap, you are still liable for five percent of the cost of your drugs. Their average annual out-of-pocket costs were just over $3,200.

Another 2.2 million people with Medicare Part D had total drug costs above the catastrophic cap. But they had a Low-Income Subsidy. That subsidy, Extra Help, helps pay Part D premiums and cost-sharing for about three in ten people enrolled in Part D.

Premiums, copays and coinsurance vary tremendously, depending upon the plan you choose and the drugs you take. As of 2019, premiums ranged from $10.40 to $156 a month. In 2018, the average monthly drug plan premium was $41.

Overall, generic drugs have far smaller out-of-pocket costs than brand-name drugs, though those costs have risen considerably over the last few years. Drugs that are considered “specialty,” which cost a minimum of $670, often have cost-sharing as high as one-third of the drugs’ price. Forty percent of people with Medicare are enrolled in Part D drug plans that charge coinsurance this high.

In 2020, the Part D standard benefit will cover a smaller portion of people’s drug costs. The deductible is $435, up from $415 in 2019. Coinsurance is 25 percent, up to an initial coverage limit of $4,020 in total drug costs (up from $3,820 in 2019), after which you are in the coverage gap. Unless you are enrolled in the Extra Help program, which helps cover your costs if your income is low, once your drug costs are higher than $4,020, you will spend 25 percent of the drug plan’s cost for covered brand-name drugs and 37 percent of the drug plan’s cost for covered generic drugs until your total out-of-pocket costs reach $6,350 (up from $5,100 in 2019) and you are no longer in the donut hole.

After that, you pay the higher of 5% of your drug costs or $3.40 for each generic and $8.50 for each brand-name drug. There is no out-of-pocket catastrophic cap.

You can check out your Part D drug options on the Medicare Plan Finder, which includes information on premiums, deductibles and the costs of drugs in different Part D drug plans. Unfortunately, the Medicare Plan Finder can be misleading and difficult to use. You can get free help from your State Health Insurance Assistance Program or SHIP. Or, you might consider these other options for keeping your drug costs down.

If you want Congress to rein in drug prices, please sign this petition.

Here’s more from Just Care: