Daniel Marans writes for the Huffington Post about Social Security’s 81-year impact. From its launch as our first national pension program for retirees, it has expanded, in line with the original vision, to cover 60 million people, including people with disabilities and their dependents as well as the partners and children of workers who die.

When Social Security was enacted in 1935, about half of all older people were living in poverty. According to a report by the Democratic staff in Congress’ Joint Economic Committee, more than 4 in ten older adults would still be living in poverty without Social Security. Thanks to Social Security, just one in ten older adults live in poverty today.

Today, 14.5 million older adults are not living in poverty because of Social Security. About 57 percent of them are women. But Social Security is an intergenerational system, in 2014, 6.4 million children, or 8.7% of all children, benefited from Social Security, up from 5.4 million (7.3%) in 2003. Social Security keeps many of those children out of poverty — the child poverty rate in families receiving Social Security is 25.5%, but it would be 42.8% without those benefits. And, Social Security benefits are designed to help lower earners more than higher earners. Social Security benefits replace about 41 percent of the income of lower earners, compared with 20 percent of the income of average earners–the amount at which people stop contributing to Social Security.

To learn more, read Social Security Works’ latest national and 50 state reports, Social Security Works for the United States and for each state.

Here’s more from Just Care:

…I am in the 90 – 100% bracket as I suffer from degenerative joint and bone pain which makes it extremely difficult to continue working in the only occupation I’ve known. I no longer can lift heavy items, climb ladders to fetch boxes, stand on my feet for a full shift anymore. My right hand is almost useless wiht almost no grop. My keyboarding speed has taken a hit from over 50 WPM to barely 20 and date entry speed is about a quarter of what the industry standard is today.

at 62 with no degree and the conditions above, I am pretty much unemployable, particularly as ageism has become so widespread in hiring and retention today. During and after the recession I’ve read countless accounts of people in the 50s and 60s who had extreme difficulty finding work and often being passed over for younger applicants. Many eventually just gave up when they reached 62 and accepted a lower SS benefit as it meant something. With my physical condition, I was advised to pursue SS disability (which I am currently in the appeals process for). which would convert to SS retirement I reach 66 in about three years. So far it has been well over a year (I have since taken on an SS disability attorney to assist with my case).

The job I worked paid extremely low in a city where rents have been skyrocketing (particularly since the recession). I was living paycheque to paycheque having to choose between paying the premium for the company sponsored health plan (which was a joke) of a monthly transit pass to get to work. Naturally the transit pass won (this was in the days before the ACA and mandatory health care went into effect). I had no extra funds to put away into savings and the company offered no retirement account plan (until after I was let go).

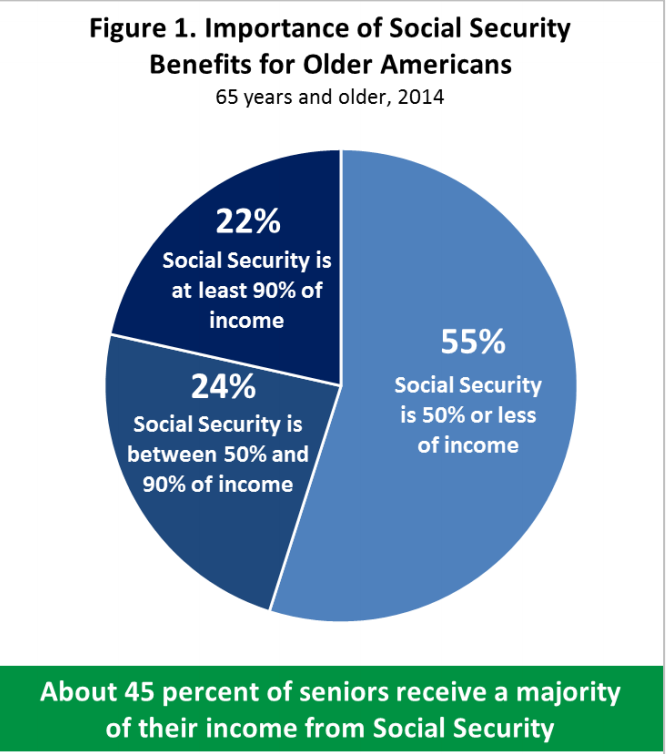

Hence, Social Security will pretty much be my only source of income (and for many of my generation who got stuck in low paying jobs as well). My monthly benefit will be just shy of 1,000$ inadequate to cover renting even a cramped studio where I live as the median rent here for a 1 BR is 1,400$. In the inner neighborhoods, where I would like to stay due to the walkability factor and decent transit, rents can be as high as 1,500$ to 1,600$. Wait lists for subsidised housing in the city are long, upwards of five years. Considering there is no COLA this year, and medicare premiums have been increased for people such as myself coming onto Social Security after January 1st of this year, I will find my self living in poverty.

When it comes to expanding Social Security benefits, the administration needs to take a hard look at what is happening to housing prices, along with the shortage of low/fixed income housing in many cities. 20$ more a month will not cut it where I live, it wouldn’t even be enough to cover the cost of a senior’s transit pass let alone rent in a city with the fastest rising rents in the nation.