This year’s Social Security and Medicare Trustees reports were released without considering the effects of the coronavirus pandemic and so are not likely to reflect the current state of these trust funds. With so many people out of work, however, less money has been going into these funds. But, Medicare and Social Security are destined to continue because of their enormous popular support and their value to Americans.

Just recently, in response to the coronavirus pandemic, Vice President Joe Biden, endorsed a plan from Senators Elizabeth Warren (D-MA) and Ron Wyden (D-OR) to provide everyone receiving Social Security benefits with $200 more a month during this pandemic. This additional income would be of enormous value to older adults and people with disabilities who are most at risk.

Nancy Altman, president of Social Security Works, writes:

“Social Security is built to be a solution in times of national emergencies and disasters. After the terrorist attacks of September 11, virtually every child who lost a parent that day received Social Security benefits, as did the surviving spouses and those disabled as a result of the attacks, and their families. Indeed, Social Security was among the first insurers working with families after the attacks. The first benefits were paid on Oct. 3, 2001, less than a month after that horrific day.

The same story unfolded in the aftermath of Hurricane Katrina. Emergency, on-the-spot payments were provided to tens of thousands of Americans who were driven from their homes and could no longer access their banks.

To withstand the current public health crisis and the associated shock to the economy, Social Security has a substantial reserve, which, according to the just-released report, equals $2.9 trillion. Its purpose is to ensure that benefits will continue to be paid on time and in full, without interruption, in times like this.

Social Security’s reserve is large enough to ensure sufficient revenue to continue to pay benefits in full and on time into the 2030s, no matter how long the current crisis lasts. When looking at the long-term, the next three-quarters of a century and beyond, the pandemic will be absorbed, as the Great Recession was.”

The Trustees project that Social Security has another 15 years of funding and Medicare has another six, just like last year. The coronavirus pandemic will likely mean that these funds will be depleted sooner. Because so many people have lost their jobs and we are moving into a recession, payroll contributions to Social Security and Medicare will decrease over the next several years. Most likely, as well, more people will apply for Social Security benefits.

That said, Congress is already strengthening the Social Security and Medicare Trust Funds through its investments in the economy. The more people working and contributing to these programs through payroll contributions, the stronger they will be. To strengthen these funds further, Congress should rein in health care spending in Medicare and throughout the health care marketplace. And, it should lift the cap on payroll contributions so that wealthy Americans contribute their fair share towards Social Security.

Here’s more from Just Care:

Don’t let Trump and the republicans in the Congress kill Social Security and Medicare. Vote blue. Send a blue tsunami through Congress and the Oval!

Trump, keep your blood-soaked hands off of our Social Security

…it will survive provided Mr. Trump and Mr. McConnell don’t gut the payroll deductions which are what fund SS and Medicare. this is a back door they are looking at to destroy these programmes, reduce benefits, and push for privatisation (which would be a disaster for seniors and the disabled and just put more money in the hands of Wall Street speculators).

What really needs to be done is eliminate the cap. It’s about time those who have far more than they will ever need help those who barley scrape by.

Many may not realise but members of both chambers of Congress, like Mr. McConnell, also collect Social Security when they reach retirement age as well as the generous pensions they receive, paid for by the taxpayers. Paul Ryan, the champion for gutting SS, received and 83,000$ a year pension that is over 7 times more than what I receive for SS and about 5 times what the average SS benefit is per year (his net worth is about 7.5$ million). Mr McConnell (who’s net worth is around 25$ million) stands to receive a healthy 6 digit annual payment. Meanwhile many of us struggle from month to month receiving living adjustments that don’t keep pace with rising costs. If benefits are reduced which would happen under Mr. Trump’s plan, many will end up on the streets. while younger generations will have little to look forward to, likely having to work until they drop.

Obama/Biden cut the payroll tax with their payroll tax holiday.

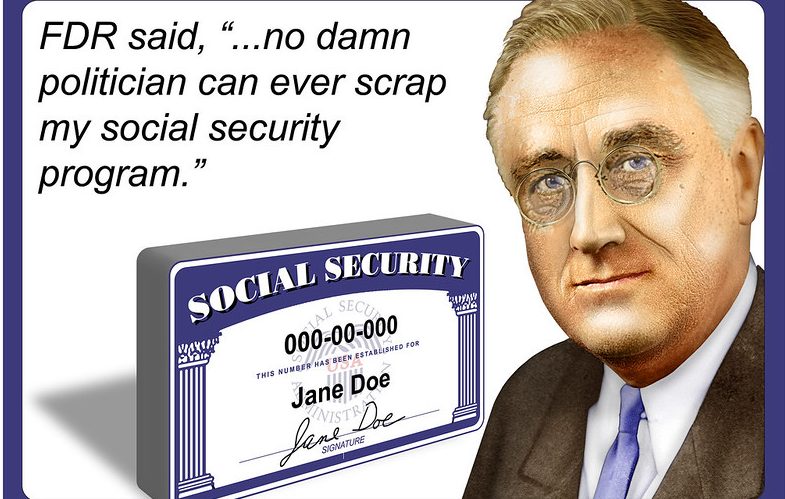

I have paid into Social Security my whole life and now that I’m getting close to retirement…. Trump wants to STEAL AMERICAN’S and MONEY….OH HELL NO!!! FDR would be rolling over in his grave if he knew a SCANDALOUS DRAFT DODGER in Chief was TRYING TO GUT HIS SOCIAL SECURITY PROGRAM!!!! WAKE UP OLD Republicans he’s going to STEAL your money to, time to switch sides!!!