Diabetes is most prevalent among people over 65. As many as 26 percent of older Americans have...

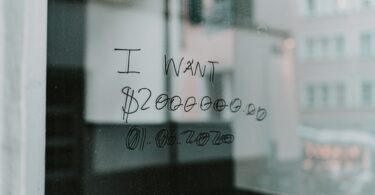

Health and financial security

Health care costs are prohibitive for one in three people with...

While in many ways Medicare is a critical guarantee of access to good affordable health care for...

Working people lose mental health parity protections

For some time, including during President Trump’s first term, the federal government has...

Health care prices continue to vary widely

The idea of shopping for health care is a joke. If you need care urgently or there’s only one...

Homelessness among older Americans on the rise: Where to turn...

Increasingly older adults are finding themselves with nowhere to live, reports Felice J. Freyer for...

Can’t afford dental care in the US? Consider visiting Los...

Burkhard Bilger reports for The New Yorker that, each morning, more than 1,000 Americans walk, bike...

UnitedHealth misleads public about Medicare Advantage through...

Earlier this year, a study published in JAMA Network about Medicare Advantage was based on biased...

Some states make it harder for private equity firms to buy...

Private equity firms are buying up our health care system piece by piece–hospitals, nursing...

Millions of Americans face higher medical bills.

Noam Levey reports for KFF Health News that President Trump’s policies will lead millions of...

Bipartisan bill attempts to fix widespread insurer underpayments...

Whatever you think about Medicare Advantage plans, HMOs and PPOs administered by corporate health...