Here’s an innovation. With few resources to keep residents active in a Dutch retirement home...

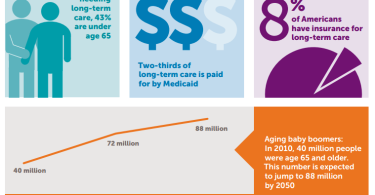

Long-term care

Nursing homes can be cool places to live: The Eden Alternative

When we think about nursing homes, many of us conjure up images of large, lifeless...

Cutting edge small nursing homes: Green Houses

If you’re looking into nursing homes for yourself or someone you love, consider a Green...

Need for more home care workers to care for older adults at home

An increasing number of older adults are choosing to age in their homes rather than in nursing...

Older and living alone, the rise of elder orphans

Elder orphans, older adults living alone, should be among the chief concerns of health policy gurus...

Community Aging in Place—Advancing Better Living for Elders...

As the population ages, many experiments are underway to understand how best to keep people living...

Long-term care is unaffordable for middle-income families

Where you live matters, for all kinds of reasons, including because it affects the long-term...

Are you ready to start thinking about long-term care? Perhaps...

It’s time to start thinking about long-term services options. According to a new Health Affairs...

Individual saving and spending for long-term care services and...

Fact: Americans pay a lot of money out of pocket for long-term care services and supports. Costs...

Medicaid, Medicare and long-term care

Long-term care can cost a lot. Medicare sometimes picks up a small piece of the cost. Medicaid...