As the debate over the future of health care in America rages on, some posit that the solution to...

Health insurance

Don’t trust your health plan’s provider directory

Traditional Medicare’s “one size fits all” approach offers a wide choice of...

Eve’s story: Commercial health insurance, inhumane choices

Millions of hard-working Americans with common health conditions struggle every day to stay healthy...

Bi-partisan bill in Congress would prevent surprise medical bills

Millions of insured Americans go to the hospital, thinking that their bills will be covered only to...

How to protect yourself from surprise medical bills?

Watch out for huge medical bills if you visit the emergency room and are enrolled in a commercial...

People shouldn’t need to shop for health care

Austin Frakt reports on a new NBER study that finds that only one in 100 Americans shop for...

If your health plan denies payment, fight back and appeal

It likely won’t be your first reaction, but when your health plan denies payment, fight back and...

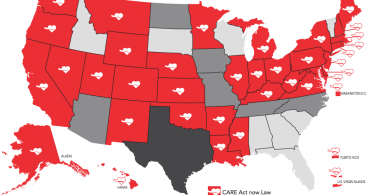

CARE Act assists family caregivers

About seven in ten older adults need long-term care at some point. In many cases, it is a family...

Before paying drug copay, ask cash price

A new JAMA research letter reports that people are paying drug copays that are higher than the...

Seven reasons commercial insurance cannot meet our health care...

As policymakers, pundits and the public consider the path to universal health care coverage in the...