Recent data from the Centers for Disease Control reveals that we need to do a better job of getting...

Your Coverage Options

Glaucoma: See a doctor if you experience loss of vision or have...

Almost one in 50 people over 40 are diagnosed with glaucoma. Glaucoma is a disease that hurts the...

Preventive care: Bone density tests and osteoporosis

Preventive care is recommended to ensure you stay healthy. Bone density tests or bone mass...

Out-of-network coverage harder to come by

If you’re shopping for health insurance in a state health exchange, you may be hard-pressed...

Social Security and Medicare benefits for people with...

About 10 million people qualify for Social Security and Medicare on the basis of a disability. ...

Beware of Medicare and Medicaid fraud and, if you see it, report...

Medicare fraud is prevalent. It wastes billions of dollars and drives up health care costs. It...

Medicare covers oxygen equipment and supplies

Medicare covers the rental of oxygen equipment and supplies if you meet the qualifying...

Two tips to help you choose a health plan

During open enrollment season, many of us struggle to figure out which health plan to choose...

7 questions you should answer before you turn 65

Everyone has lots of questions about their health and financial security as they age. Here are...

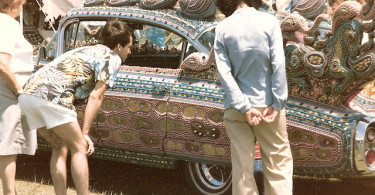

The “Cadillac” tax hurts millions of working people

It seems fair to impose higher taxes on luxury goods. But, the “Cadillac” tax included...