As a result of inflation, people on fixed incomes find that their incomes decline in value over...

Social Security

How to maximize Social Security benefits

The Pew Charitable Trust released a report explaining how to maximize Social Security benefits. The...

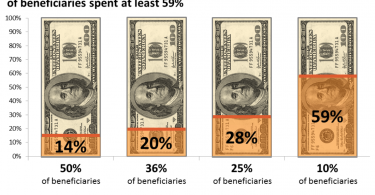

People with Medicare spend an average of $5,500 on health care...

Medicare works to ensure people access to quality affordable health care, but average out-of-pocket...

2018 Social Security benefits should rise, but checks may not

One of the strengths of Social Security is that benefits are adjusted annually to offset increases...

When to claim Social Security benefits

When deciding when to stop working and when to claim Social Security benefits, there is a lot to...

Social Security and Medicare benefits for people with...

About 10 million people qualify for Social Security and Medicare on the basis of a disability. ...