Every state has an agency that provides protective services to adults. These adult protective services agencies collect and report data on abuses, including financial exploitation. But, the GAO reports that the data collection and reporting is not what it needs to be to understand the scope of the problem nationally and help older adults, their families and society at large.

As you might imagine, older adults can be easy targets for financial exploitation by family, friends and unknown predators. There are so many types of scams. And, older adults might lose the mental acuity needed to manage their money without being scammed. Their judgment might be impaired because of dementia. But, with a good understanding of the biggest issues, interventions can be developed to help them.

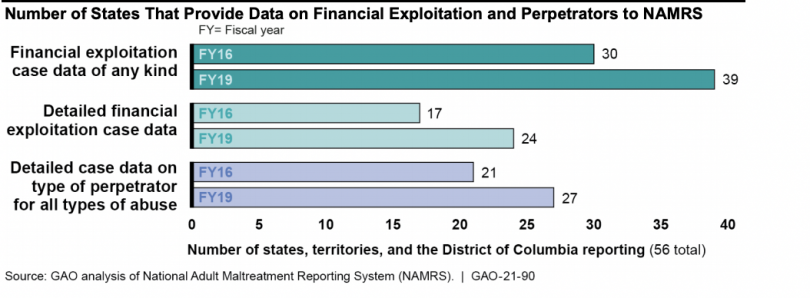

Right now, state reporting of data to the US Department of Health and Human Services (HHS) is voluntary. According to the GAO, 11 states and territories out of 56 do not report any financial exploitation data at all. Fewer than half of all states, 24, provide HHS with detailed financial exploitation case data. And, only 27 provide detailed HHS with case data on the the type of perpetrator.

Without this data, the federal government does not have the needed information to devise strategies to minimize financial exploitation and develop interventions to improve the lives of abused and neglected older adults.

To be sure, states cannot collect complete information on financial exploitation of older adults. Many instances are not reported. Often older adult victims do not want to implicate family members. But, to the extent states have this data it is generally not easily shareable with the federal government and it should be.

Because complete and accurate national financial exploitation data is not available, we do not know the extent to which property and funds of older adults are illegally or wrongfully used. According to the Consumer Financial Protection Bureau, banks reported actual losses and attempts at elder financial exploitation totaling $1.7 billion in 2017. As high as that might seem, it appears it could be closer to $50 billion if complete data were collected everywhere in the country.

Recent studies in New York, Pennsylvania, and Virginia, however, suggest the cost is likely to be more than $1 billion in each state. The GAO recommends that HHS do more to ensure states report the information they collet. States tend not to submit data on the cost of financial exploitation of older adults to HHS because they do not feel the need to do so.

Here’s more from Just Care: