A new report by the Government Accountability Office reveals that Social Security provides critical financial support in retirement. As it is, most adults 55 and older have no retirement savings. And, those with retirement savings have so little savings that they will need to depend heavily on Social Security income.

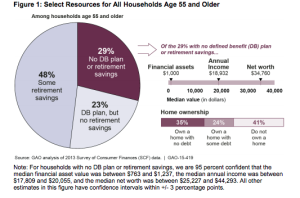

Today, 52 percent of households 55 and older have no retirement savings. More than half of those without retirement savings, 29 percent, also do not have a defined benefit plan.

When you break down the numbers, it turns out that 27 percent of both the households with people between 55 and 64 and those with people between 65 and 74 have neither retirement savings nor a defined benefit plan. Because of Social Security benefits, median annual income for the 65 to 74 year olds is $47,000, more than twice that of people between 55 and 64–Social Security benefits represent 44 percent of income or $19,000. Median annual income for the younger 55 to 64 cohort is around $21,000.

Households with people over 75 rely on Social Security for the better part of their income. About 35 percent of them have neither retirement savings nor a defined benefit plan. Social Security represents about 61 percent of household income, averaging $17,000 a year.

The vast majority of households over 65, 86 percent, receive Social Security benefits. And 96 of U.S. workers have jobs for which they are eligible to receive these benefits. Social Security benefits represent an average of 52 percent of income for people 65 and older.

.

what is a defined benefit plan?