It seems fair to impose higher taxes on luxury goods. But, the “Cadillac” tax included in the Affordable Care Act taxes costly health insurance policies, even when they are not especially generous. It assumes that insurance is excessive based on premiums charged; but, premiums stem in considerable part from doctor and hospital rates as well as from the health profile of the people the insurance is covering; they may have little or no bearing on the quality of the insurance.

Tim Jost explains the policy rationale for the tax: “The Cadillac tax is intended to limit the generosity of employer coverage on the theory that excess coverage encourages excess health care expenditures and thus drives up the total cost of health care.” But, this tax does nothing to ensure people make smarter health care choices, as supporters of the tax would like people to believe. Rather, the tax simply requires people to spend more of their own money on health care, which can keep them from getting needed care. For a detailed critique of the tax by Tim Jost and Joe White, click here.

There is a push to repeal the Cadillac tax because it will penalize working people. With a Cadillac tax, many employers are likely to provide less costly health insurance that includes higher deductibles (which are already up 67 percent since 2010) and copays, in order to avoid the tax. This will jeopardize access to care for many low-income workers and workers with costly conditions. The tax will apply to families with annual insurance premiums of $27,500 and individuals with annual insurance premiums of $10,200. If it is not repealed, it will go into effect in 2018.

Bernie Sanders has opposed the tax since 2009. And, Hillary Clinton has just taken a stand against it as well. But, the President and many members of Congress support it.

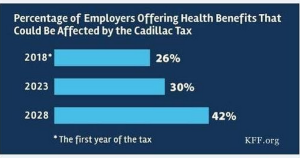

Here’s the Kaiser Family Foundation’s chart showing the percentage of employers that could be affected by the tax.