What will your Social Security benefit be when you retire? Knowing how much you will receive from...

Social Security

Wait to claim Social Security benefits, if possible

You have earned your Social Security benefits. You should claim them when it meets your personal...

Social Security turns 88 today; it’s time to expand its...

On August 14th, 1935, President Franklin D. Roosevelt signed Social Security into law. Eighty-eight...

Health care costs eat into your 2021 Social Security benefits

Mark Miller writes for his subscription blog, RetirementRevised.com on how cost of living...

Social Security: Always there for you in a crisis

On this 19th anniversary of the horrific attacks of September 11, 2001, we find ourselves in the...

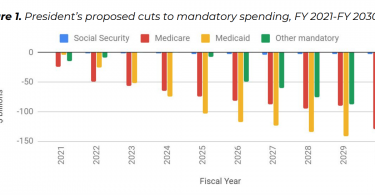

President Trump’s 2021 proposed budget would most hurt...

Monique Morrissey writes for the EPI blog about President Trump’s proposed 2021...

Enrolling in Medicare? Here’s a checklist

Most people get Medicare just before they turn 65 (though people with disabilities get Medicare...

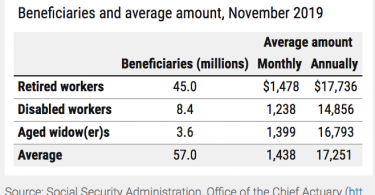

Social Security benefits are relatively small

As often as they can, Republicans in Congress argue to “reform” Social Security...

Top Social Security questions and answers

The New York Times answered the top Social Security questions from its readers. Question 1. Is...

Social Security: What to know before claiming benefits

Bloomberg News reports that Americans lose trillions of dollars because they do not claim Social...