The Pew Charitable Trust released a report explaining how to maximize Social Security benefits. The report focuses on auto-IRAs, but the strategy applies to retirement savings more generally. If possible, it advises spending retirement savings to cover your needs after you retire, as a way to postpone claiming Social Security benefits.

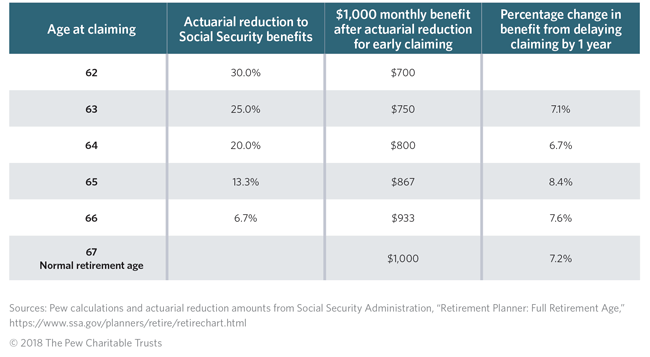

If you can delay claiming Social Security benefits from age 62 to age 70, you can increase your monthly benefits significantly. But even if you cannot hold off eight years, delaying four years to a full retirement age of 66, means about a 25 percent larger monthly Social Security check. And, even delaying one year can gain you between seven percent and eight percent more in Social Security benefits, depending upon your age.

Today, most employer retiree plans are defined contribution plans, meaning that a particular amount of money is set aside for your retirement. Unlike defined benefit plans, which guarantee you a particular retiree income each year, defined contribution plans can go up or down with the stock and bond markets and offer no guarantees. So, the question becomes how to use your retiree funds wisely.

If your employer does not offer you a retiree savings plan, many states are setting up auto-IRAs or “Secure Choice” programs. These programs automatically enroll you in a retiree savings plan that puts a percentage of your salary or wages into your retiree savings plan each month. You can opt out or change the percentage if you like. California, Connecticut, Illinois, Maryland and Oregon are in the midst of putting these auto-IRAs into place. In Oregon, employees automatically put 5% of their gross pay into their auto-IRAs in year one and 1% more each new year, with a 10% auto-contribution cap.

The auto-IRAs, much like 401(k) plans and other employer retiree plans, would permit you to use the money in those accounts to postpone signing up for Social Security. You could withdraw the amount you otherwise would have received from Social Security had you enrolled.

By using auto-IRA or employer retiree plan funds to pay for expenses post-retirement, instead of enrolling in Social Security, you can increase your total retirement benefits. Married couples can benefit even more because when one of them dies, the surviving spouse will receive the higher of the couple’s individual benefits.

Of course, not everyone will be able to make use of this strategy or benefit from it. For example, people in poor health or people with shorter life expectancies may want or need to claim Social Security benefits sooner. Moreover, if they delay claiming benefits and live a shorter than average life, their total lifetime benefits may be less than they would have received had they enrolled earlier.

- Mother’s Day Gift: The Ten Should-Do’s for Your Health, Purse and Peace of Mind, Chapter One of Aging, Schmaging, a forthcoming book by Diane Archer

- When to claim Social Security benefits

- Six things to know about your 2018 Social Security benefits

- Four things to think about when choosing between traditional Medicare and Medicare Advantage plans

- Programs that lower your costs if you have Medicare

…ideal, but not always possible.

First savings. if you worked long in a decent paying occupation that allowed for a reasonable amount of discretionary income, then yes you would be foolish not to put money away for retirement. If on the other hand you worked long years in a job that was low paying to where you were living paycheque to paycheque, deferring and juggling bills each month just to survive (such as was my situation) , not a possibility. Since the decline of organised labour that began in the 1980s, wages for many blue collar (non college degree) jobs stagnated or increased very little to keep pace with costs. New clauses such as At Will employment and more recently “Right To Work” laws, helped transferred more power upwards from the employees to management. Depending on the company and/or its management, asking for a raise or a better working situation could be construed that you didn’t like your job and they would come back saying they could hire someone else to do it (which was the case where I worked). Basically it fostered a style of managing employees out of fear. For many of us the recession didn’t help either as it wiped out what little savings people did have to make it when UI was cut off while millions were still out of work looking.

Next, working later in life. Again, nice ideal, but unless you are in an occupation that is in high demand this has been made difficult by the rising practise of ageism in hiring and retention. The worst area for ageism is one where seen to be where future job growth is, the tech sector. In many tech industries people are considered “over the hill” when they reach 40 – 45. This is also an area where many jobs are outsourced outside the country or have been turned into limited term contract positions. Many of these positions also require a degree, so if you don’t already have one there is the expense (usually in debt) of that. As we grow older our bodies no longer can do what they used to, so many occupations with demanding physical requirements are out. So what is left? Walmart? McDonalds? Amazon? Call centres? Consumer electronics companies like Foxconn? (all which usually pay low wages, offer few benefits, and often try to squeeze as much out of their workforce as they can for as little cost as they can).

Another specter waiting in the wings is automation which will first begin replacing people in many of those routine unskilled and even semi-skilled occupations above. What is one to do if there are more people looking for work just to “get by” on for a few more years as those opportunities decline? What will employers do, what basis will they use in deciding who to hire and who not to? I fear ageism will become worse as automation expands since it is so easy to get around it with a few simple words like “you’re overqualified” or “not a good fit” without making it sound like they are turning you down because of your age (which they are). Where does the money come for lawyers and court fees if you attempt to file a discrimination case (which can take long to pursue, is stressful, and possibly could result in a denial)? Also if you did win, would you feel comfortable walking into a workplace where the owner or management just paid a judgement as well as for their attorneys to keep you from being there? I certainly wouldn’t.

So again, if you come form the poor side of the economic tracks, taking what you can get is better than nothing and being on the street.