As often as they can, Republicans in Congress argue to “reform” Social Security benefits. That’s code for cutting benefits. In truth, Social Security benefits are relatively small.

Social Security benefits are earned benefits, with people contributing over their lifetime into the Social Security Trust Fund. Only money from that Trust Fund goes to pay people’s Social Security benefits. So, Social Security benefits do not affect the deficit.

The principal reason that Social Security faces a long-term shortfall is that more people are relying on it. There are more older adults and more people with disabilities than ever before. So, Social Security is paying out more money than it has in the past. Social Security’s costs are about five percent of GDP today and are projected to rise to six percent in the 2030’s.

The overwhelming majority of Americans, along with Democrats in Congress, believe that Social Security needs to be expanded, not cut. While Social Security faces a long-term shortfall, there is no need to cut benefits. As of now, it has enough money to pay out benefits until 2035. And, after that, it has enough money to pay out three-quarters of the benefits it owes, if nothing is done to shore up the Trust Fund.

Social Security protects workers and their families when they retire or have a disability or die. Here are five important things to remember about Social Security from the Center on Budget and Policy Priorities.

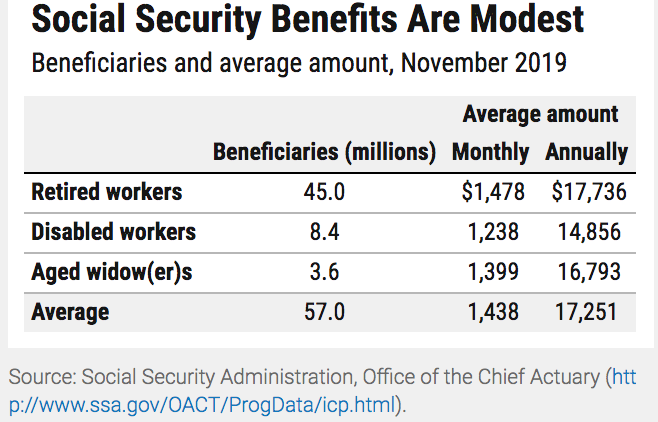

Social Security benefits are relatively small. They average under $1,500 a month and under $18,000 a year. As a result many older adults live in poverty or near poverty, when you factor in their out-of-pocket health care costs.

The majority of people depend heavily on Social Security when they retire or become disabled. About one in two older adults receiving Social Security depend on it for half or more of their income. About one in four older adults depend on it for 90 percent of their income. And, around one in four older adults has an annual household income under $20,000. Just one in ten retiree households has an annual income averaging $230,000.

Including Social Security income, the median household annual income was around $44,000 in 2012. If you look at median household income by race and ethnicity, white and Asian households had far higher incomes than Black and Latino households, $47,000 and $48,000 respectively as compared to $32,000 and $30,000 respectively.

For many reasons, means-testing Social Security benefits would not help to shore up the Social Security Trust Fund. There are so few retiree households with significant incomes that if you only means-tested retirees in the top 10 percent of income earners, it would not generate a meaningful amount of money. To generate adequate revenue, the federal government would have to reduce benefits of households with low incomes. Moreover, administrative costs would be high.

Only Social Security provides the majority of older adults guaranteed income for as long as they live, with some inflation protection. Fewer and fewer retirees can count on defined benefit plans in addition to Social Security income. Defined benefit plans pay people a guaranteed amount every year in retirement. Instead, people tend to have defined contribution plans, if they have an additional income source in retirement. These plans have no guarantees. If the stock market falls, people can easily lose income they need. If it collapses, people might have to depend entirely on Social Security.

Several other developed countries provide higher Social Security benefits to their citizens than the United States. The United States might be the wealthiest country in the world, but it ranks in the bottom third of developed countries in terms of the generosity of its retirement benefits. While Social Security benefits in the US are better than in Japan, Mexico and the United Kingdom, they are far less generous than in the majority of developed countries, including Turkey, Italy, Austria and Spain. Social Security benefits replace, on average, less than half of Americans’ income. On average, other developed countries replace 58 percent of their citizens’ income.

Most of the Democratic presidential candidates are proposing to expand Social Security benefits. Senator Warren has a plan to increase benefits by $200 a month. Others support Congressman Larson’s Social Security 2100 Act.

Because Congress raised the age of eligibility for Social Security from 65 to 67 and because Medicare costs are rising, people retiring down the road will receive less from Social Security than people today. People born in 1960 will not receive full Social Security retirement benefits until the age of 67. In simple terms, on average, retirees are losing two years worth of Social Security benefits–more than $35,000 in income–which retirees born in 1937 and earlier received.

If you would like Congress to expand Social Security, please sign this petition.

Here’s more from Just Care:

Elect Warren to the best possible changes for our country.

I am a retired college instructor/consultant living on social security and savings. I was forced to retire at age 62 because my employer kept cancelling my classes. I only get about $1,170 in benefits which will be reduced when I receive Medicare. If it weren’t for my spouses salary and savings, I’d be destitute. It’s not fair that people who have worked over 40 years should have to live in poverty.

Gop will do what ever it takes to go after the SSI funds . How about cutting all trumps golf trips, trip to Marlargo and trips to foreign lands. His security expenses are out of control. If trump want to take a trip, “ go with at your own expense. Tired of pay for a bum like the one Oval Office. It’s also becoming more then obvious that congress has became dysfunctional, and should have their wages, health care and other benefits cut. Let’s start cuts at the top like Japan.